Bed, Bath and Beyond 2006 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2006 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2006

28

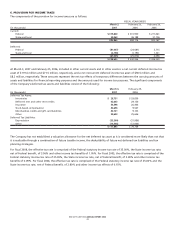

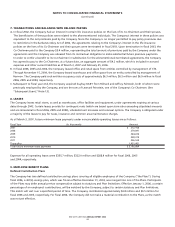

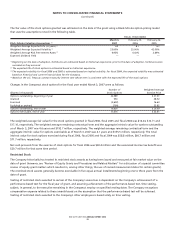

The fair value of the stock options granted was estimated on the date of the grant using a Black-Scholes option-pricing model

that uses the assumptions noted in the following table.

FISCAL YEAR ENDED

March 3, February 25, February 26,

Black-Scholes Valuation Assumptions (1) 2007 2006 2005

Weighted Average Expected Life (in years) (2) 6.3 6.1 6.1

Weighted Average Expected Volatility (3) 25.00% 25.00% 42.00%

Weighted Average Risk Free Interest Rates (4) 4.95% 4.02% 3.89%

Expected Dividend Yield ———

(1) Beginning on the date of adoption, forfeitures are estimated based on historical experience; prior to the date of adoption, forfeitures were

recorded as they occurred.

(2) The expected life of stock options is estimated based on historical experience.

(3) The expected volatility for fiscal 2006 and 2005 is estimated based on implied volatility. For fiscal 2004, the expected volatility was estimated

based on historical and current financial data for the Company.

(4) Based on the U.S. Treasury constant maturity interest rate whose term is consistent with the expected life of the stock options.

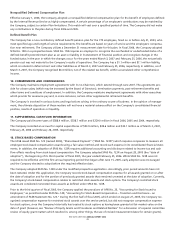

Changes in the Company’s stock options for the fiscal year ended March 3, 2007 were as follows:

Number of Weighted Average

(Shares in thousands) Stock Options Exercise Price

Options outstanding, beginning of year 22,589) $ 27.01

Granted 550) 38.52

Exercised (2,603) 16.63

Forfeited or expired (700) 35.82

Options outstanding, end of year 19,836) $ 29.99

Options exercisable, end of year 11,016) $ 25.61

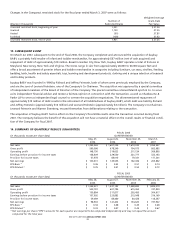

The weighted average fair value for the stock options granted in fiscal 2006, fiscal 2005 and fiscal 2004 was $14.24, $12.71 and

$17.16, respectively. The weighted average remaining contractual term and the aggregate intrinsic value for options outstanding

as of March 3, 2007 was 4.6 years and $192.7 million, respectively. The weighted average remaining contractual term and the

aggregate intrinsic value for options exercisable as of March 3, 2007 was 4.1 years and $155.5 million, respectively. The total

intrinsic value for stock options exercised during fiscal 2006, fiscal 2005 and fiscal 2004 was $58.8 million, $60.7 million and

$71.7 million, respectively.

Net cash proceeds from the exercise of stock options for fiscal 2006 was $43.4 million and the associated income tax benefit was

$20.7 million for that same time period.

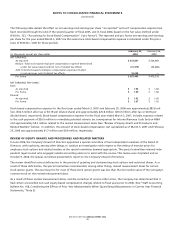

Restricted Stock

The Company historically has treated its restricted stock awards as having been issued and measured at fair market value on the

date of grant (however, see “Review of Equity Grants and Procedures and Related Matters” for a discussion of a special committee

review of equity grant matters which resulted in, among other things, the use of revised measurement dates for certain grants).

The restricted stock awards generally become exercisable in five equal annual installments beginning one to three years from the

date of grant.

Vesting of restricted stock awarded to certain of the Company’s executives is dependent on the Company’s achievement of a

performance-based test for the fiscal year of grant, and assuming achievement of the performance-based test, time vesting,

subject, in general, to the executive remaining in the Company’s employ on specified vesting dates. The Company recognizes

compensation expense related to these awards based on the assumption that the performance-based test will be achieved.

Vesting of restricted stock awarded to the Company’s other employees is based solely on time vesting.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)