Bed, Bath and Beyond 2006 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2006 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2006

19

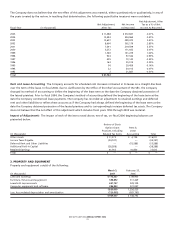

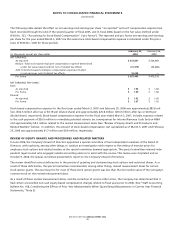

T. Vendor Allowances

The Company receives allowances from vendors in the normal course of business for various reasons including direct cooperative

advertising, purchase volume and reimbursement for other expenses. Annual terms for each allowance include the basis for

earning the allowance and payment terms which vary by agreement. All vendor allowances are recorded as a reduction of inven-

tory cost, except for direct cooperative advertising allowances which are specific, incremental and identifiable. The Company

recognizes purchase volume allowances as a reduction of the cost of inventory in the quarter in which milestones are achieved.

Advertising costs were reduced by direct cooperative allowances of $10.6 million, $9.4 million and $8.7 million for fiscal 2006,

2005 and 2004, respectively.

U. Store Opening, Expansion, Relocation and Closing Costs

Store opening, expansion, relocation and closing costs, including markdowns, asset residual values and projected occupancy costs,

are charged to earnings as incurred.

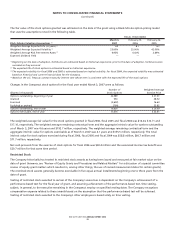

V. Advertising Costs

Expenses associated with store advertising are charged to earnings as incurred. Net advertising costs amounted to $198.4 million,

$158.2 million and $134.5 million for fiscal 2006, 2005 and 2004, respectively.

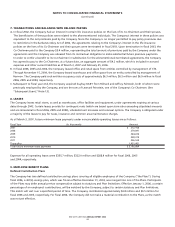

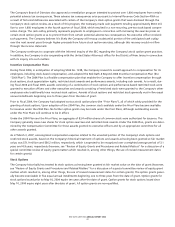

W. Stock-Based Compensation

The FASB issued SFAS No. 123 (revised 2004), “Share-Based Payment” (“SFAS No. 123R”) which requires companies to measure all

employee stock-based compensation awards using a fair value method and record such expense in its consolidated financial state-

ments. In addition, the adoption of SFAS No. 123R requires additional accounting and disclosure related to income tax and cash

flow effects resulting from stock-based compensation. The Company adopted SFAS No. 123R on August 28, 2005 (the “date of

adoption”), the beginning of its third quarter of fiscal 2005, the year ended February 25, 2006. While SFAS No. 123R was not

required to be effective until the first annual reporting period that began after June 15, 2005, early adoption was encouraged

and the Company elected to adopt before the required effective date.

Under SFAS No. 123R, the Company uses a Black-Scholes option-pricing model to determine the fair value of its stock options.

The Black-Scholes model includes various assumptions, including the expected life of stock options, the expected volatility and the

expected risk free interest rate. These assumptions reflect the Company’s best estimates, but they involve inherent uncertainties

based on market conditions generally outside the control of the Company. As a result, if other assumptions had been used, total

stock-based compensation cost, as determined in accordance with SFAS No. 123R could have been materially impacted. Further-

more, if the Company uses different assumptions for future grants, stock-based compensation cost could be materially impacted

in future periods.

Also, under SFAS No. 123R, the Company is required to record stock-based compensation expense net of estimated forfeitures.

The Company’s forfeiture rate assumption used in determining its stock-based compensation expense is estimated based on

historical data. The actual forfeiture rate could differ from these estimates.

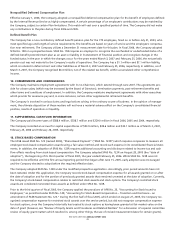

Prior to the third quarter of fiscal 2005, the Company applied the provisions of APB No. 25, “Accounting for Stock Issued to

Employees,” as permitted under SFAS No. 148, “Accounting for Stock-Based Compensation – Transition and Disclosure – an

amendment of FASB Statement No. 123” and complied with the disclosure requirements of SFAS 123. During the first half of fiscal

2005, which ended on August 27, 2005, the Company recognized compensation expense for restricted stock awards over the serv-

ice period, but did not recognize compensation expense for stock options, since the Company historically has treated its stock

options as having been granted at fair market value on the date of grant (however, see “Review of Equity Grants and Procedures

and Related Matters, ” Note 12 for a discussion of a special committee review of equity grant matters which resulted in, among

other things, the use of revised measurement dates for certain grants). No compensation expense for stock-based awards was rec-

ognized in fiscal 2004.

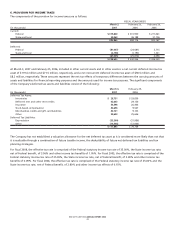

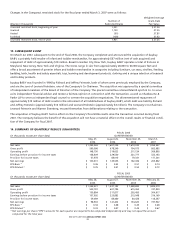

X. Income Taxes

The Company files a consolidated Federal income tax return. Income tax returns are filed with each state and territory in which

the Company conducts business.

The Company accounts for its income taxes using the asset and liability method. Deferred tax assets and liabilities are recognized

for the future tax consequences attributable to the differences between the financial statement carrying amounts of existing

assets and liabilities and their respective tax bases and operating loss and tax credit carryforwards. Deferred tax assets and liabili-

ties are measured using enacted tax rates expected to apply to taxable income in the year in which those temporary differences

are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in

earnings in the period that includes the enactment date.