Bed, Bath and Beyond 2006 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2006 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2006

1

To Our Fellow Shareholders: Continued from front cover

On the following pages, we present an overview of our recently completed fiscal 2006. We also will provide you with

the information you need in connection with our upcoming Annual Meeting.

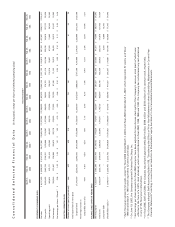

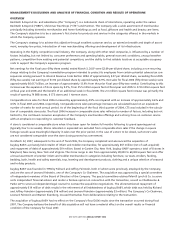

Fiscal 2006 was our 36th year of operations, and our 15th as a public company. As set forth below, the results during fiscal

2006 were our best ever. Here are some of the highlights:

• Net earnings for the fiscal year (fifty-three weeks) ended March 3, 2007 were $2.09 per diluted share. This included a

non-recurring charge of approximately $.07 per diluted share to protect our associates from certain potential adverse tax

consequences arising pursuant to Internal Revenue Code Section 409A. The $2.09 exceeded fiscal 2005 (fifty-two weeks)

net earnings of $1.92 per diluted share by approximately 8.9%. Earnings before the one-time charge exceeded fiscal 2005 per

share net earnings by approximately 12%. Recall that, as previously disclosed, fiscal 2005 included only one-half year of stock

option expense related to our Company’s early adoption of SFAS No.123(R) while fiscal 2006 included a full year.

• Net sales for fiscal 2006 (fifty-three weeks) were approximately $6.6 billion, an increase of approximately 13.9%

from the prior year’s sales of $5.8 billion.

• Comparable store sales for fiscal 2006 increased by approximately 4.9%, on top of an increase of approximately 4.6% in fiscal

2005. All comparable store sales percentages are calculated based on an equivalent number of weeks for each annual period.

• During fiscal 2006, we opened 74 new Bed Bath & Beyond stores. We ended the year with 815 Bed Bath & Beyond stores in

48 states, the District of Columbia and Puerto Rico, 34 Christmas Tree Shops stores in eight states, and 39 Harmon stores in

three states.

• At the close of fiscal 2006, cash and investments totaled approximately $1.1 billion, even after deducting cash used in our

expansion program, ongoing infrastructure enhancements and share repurchase activity.

• We returned approximately $301 million in value to our shareholders during our fiscal fourth quarter through our ongoing

share repurchase program.

In addition, during the past year our Company continued its efforts toward the reduction of its consumption of natural

resources, which we discussed in our letter last year. For example, our Company opened a pilot Bed Bath & Beyond store that

incorporates a range of design and technology features to reduce energy consumption, such as skylights coupled with automatic

light dimmers and advanced control programming in a system that creates energy savings equivalent to turning 25% of the

store’s lights off every day for 16 hours. This store also features compact fluorescent lighting in vignettes, LED building sign

lighting instead of neon, and a number of other conservation technologies including solar sink faucets that use ambient light to

power the equipment that automatically turns water on and off, saving both energy and water. Further, our Company started

buying hybrid cars for certain personnel whose jobs entail frequent car travel. Looking forward, our Company has plans to install

solar arrays on four New Jersey facilities. When completed, these facilities will make us one of the largest solar energy producers

in the State of New Jersey, conserving an estimated 109,500 barrels of oil and reducing carbon dioxide by 38 million pounds

over a 30-year period. Our Company also established a committee of senior management to oversee and coordinate our many

efforts in the area of energy conservation and general environmental responsibility, and to evaluate means available to make

more public disclosure on our response to these important issues.

We also want to take this opportunity to introduce Patrick Gaston to our fellow shareholders. Patrick has been elected

to our Board of Directors and brings a wealth of wisdom and experience from his many years at Verizon, where he has served

in a variety of management positions and now heads Verizon Foundation. He also serves on the boards of various charitable

organizations.

Continued on page 2