Bed, Bath and Beyond 2006 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2006 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2006

8

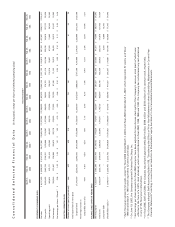

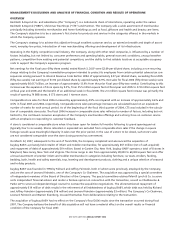

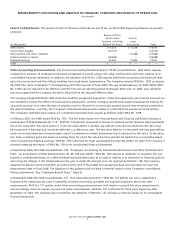

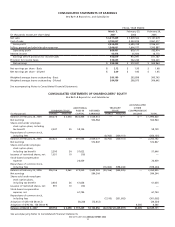

Impact of Adjustments The impact of each of the items noted above, net of tax, on fiscal 2006 beginning balances are present-

ed below:

Review of Stock

Option Grant Rent &

Practices, Including Lease

(in thousands) Related Tax Items Accounting Total

Other Assets $ 11,273)$ 4,738)$ 16,011)

Income Taxes Payable (34,747) —)(34,747)

Deferred Rent and Other Liabilities —)(15,588) (15,588)

Additional Paid-in Capital (38,288) —)(38,288)

Retained Earnings 61,762)10,850)72,612)

Total $—)$—)$—)

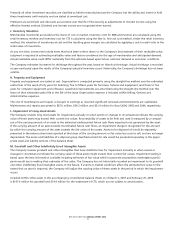

Other Accounting Pronouncements The Financial Accounting Standards Board (“FASB”) issued SFAS No. 123R which requires

companies to measure all employee stock-based compensation awards using a fair value method and record such expense in its

consolidated financial statements. In addition, the adoption of SFAS No. 123R requires additional accounting and disclosure relat-

ed to income tax and cash flow effects resulting from stock-based compensation. The Company adopted SFAS No. 123R on August

28, 2005 (the “date of adoption”), the beginning of its third quarter of fiscal 2005, the year ended February 25, 2006. While SFAS

No. 123R was not required to be effective until the first annual reporting period that began after June 15, 2005, early adoption

was encouraged and the Company elected to adopt before the required effective date.

The Company adopted SFAS No.123R under the modified prospective application. Under this application, prior period amounts are

not restated to include the effects of stock-based compensation, and the Company records stock-based compensation expense for

all awards granted on or after the date of adoption and for the portion of previously granted awards that remained unvested at

the date of adoption. Currently, the Company’s stock-based compensation relates to restricted stock awards and stock options.

The Company’s restricted stock awards are considered nonvested share awards as defined under SFAS No. 123R.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities-Including an

amendment of FASB Statement No. 115.” SFAS No. 159 permits companies to choose to measure certain financial assets and liabili-

ties at fair value (the “fair value option”). If the fair value option is elected, any upfront costs and fees related to the item must

be recognized in earnings and cannot be deferred, e.g. debt issue costs. The fair value election is irrevocable and may generally be

made on an instrument-by-instrument basis, even if a company has similar instruments that it elects not to fair value. At the adop-

tion date, unrealized gains and losses on existing items for which fair value has been elected are reported as a cumulative adjust-

ment to beginning retained earnings. SFAS No. 159 is effective for fiscal years beginning after November 15, 2007. The Company is

currently assessing the impact of SFAS No. 159 on its consolidated financial statements.

In September 2006, the FASB issued SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension and Other Postretirement

Plans – an amendment of FASB Statements No. 87, 88, 106 and 132(R).” SFAS No. 158 requires an employer to recognize the over-

funded or underfunded status of a defined benefit postretirement plan as an asset or liability in its statement of financial position

and recognize changes in the funded status in the year in which the changes occur. As required by SFAS No. 158, the Company

adopted the balance sheet recognition provisions at the end of fiscal 2006 on a prospective basis and will adopt the year end

measurement date in fiscal 2008. The adoption of this guidance did not have a material impact on the Company’s consolidated

financial statements. (See “Employee Benefit Plans,” Note 9).

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements.” SFAS No. 157 defines fair value, establishes a

framework for measuring fair value in generally accepted accounting principles and expands disclosures about fair value

measurements. SFAS No. 157 applies under other accounting pronouncements that require or permit fair value measurements

and accordingly, does not require any new fair value measurements. SFAS No. 157 is effective for fiscal years beginning after

November 15, 2007. The Company does not believe the adoption of SFAS No. 157 will have a material impact on its consolidated

financial statements.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(continued)