Bed, Bath and Beyond 2006 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2006 Bed, Bath and Beyond annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BED BATH& BEYOND ANNUAL REPORT 2006

16

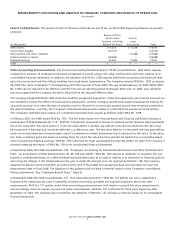

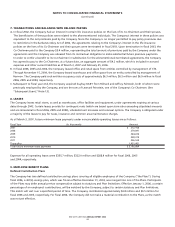

In September 2006, the FASB issued SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension and Other Postretirement

Plans – an amendment of FASB Statements No. 87, 88, 106 and 132(R).” SFAS No. 158 requires an employer to recognize the over-

funded or underfunded status of a defined benefit postretirement plan as an asset or liability in its statement of financial position

and recognize changes in the funded status in the year in which the changes occur. As required by SFAS No. 158, the Company

adopted the balance sheet recognition provisions at the end of fiscal 2006 on a prospective basis and will adopt the year end

measurement date provisions in fiscal 2008. The adoption of this guidance did not have a material impact on the Company’s

consolidated financial statements. (See “Employee Benefit Plans,” Note 9).

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements.” SFAS No. 157 defines fair value, establishes

a framework for measuring fair value in generally accepted accounting principles and expands disclosures about fair value

measurements. SFAS No. 157 applies under other accounting pronouncements that require or permit fair value measurements

and accordingly, does not require any new fair value measurements. SFAS No. 157 is effective for fiscal years beginning after

November 15, 2007. The Company does not believe the adoption of SFAS No. 157 will have a material impact on its consolidated

financial statements.

In June 2006, the FASB issued FASB Interpretation No. (“FIN”) 48, “Accounting for Uncertainty in Income Taxes – An Interpretation

of FASB Statement No. 109.” FIN No. 48 prescribes a recognition threshold and measurement attribute for the financial statement

recognition and measurement of a tax position taken or expected to be taken in a tax return. FIN No. 48 is effective for fiscal

years beginning after December 15, 2006. The Company does not believe the adoption of FIN No. 48 will have a material impact

on its consolidated financial statements.

In June 2006, the FASB’s Emerging Issues Task Force (“EITF”) reached a consensus on Issue No. 06-3, “How Taxes Collected from

Customers and Remitted to Governmental Authorities Should be Presented in the Income Statement (That Is, Gross versus Net

Presentation).” The scope of EITF 06-3 includes sales, use, value added and some excise taxes that are assessed by a governmental

authority on specific revenue-producing transactions between a seller and customer. EITF 06-3 requires disclosure of the method

of accounting for the applicable assessed taxes and the amount of assessed taxes that are included in revenues if they are

accounted for under the gross method. EITF 06-3 is effective for interim and annual periods beginning after December 15, 2006.

EITF 06-3 will not impact the method for recording these taxes in the Company’s consolidated financial statements as the

Company historically has presented sales excluding these taxes.

In October 2005, the FASB issued FASB Staff Position (“FSP”) 13-1, “Accounting for Rental Costs Incurred during a Construction

Period.” FSP 13-1 requires rental costs associated with ground or building operating leases that are incurred during a construction

period be recognized as rental expense. FSP 13-1 was effective for the first reporting period beginning after December 15, 2005.

The adoption of FSP 13-1 did not have a material impact on the Company’s consolidated financial statements.

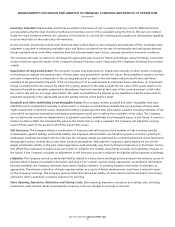

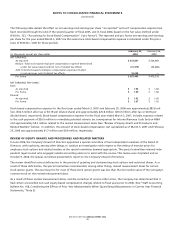

G. Fair Value of Financial Instruments

The Company’s financial instruments include cash and cash equivalents, investment securities, accounts payable and certain

other liabilities. The Company’s investment securities consist primarily of held-to-maturity debt securities which are stated at amor-

tized cost and available-for-sale debt securities which are stated at their approximate fair value. The book value of all financial

instruments is representative of their fair values with the exception of investment securities (See “Investment Securities,” Note 5).

H. Cash and Cash Equivalents

The Company considers all highly liquid instruments purchased with original maturities of three months or less to be cash

equivalents. Included in cash and cash equivalents are credit and debit card receivables from banks, which typically settle within

5 business days, of $44.3 million and $34.9 million as of March 3, 2007 and February 25, 2006, respectively.

I. Investment Securities

Investment securities primarily consist of auction rate securities, U.S. Government Agency debt securities and municipal debt

securities. Auction rate securities are securities with interest rates that reset periodically through an auction process. Auction rate

securities are classified as available-for-sale and are stated at cost or par value which approximates fair value due to interest rates

which reset periodically, typically within 35 days. As a result, there are no cumulative gross unrealized holding gains or losses

relating to these auction rate securities. All income from these investments is recorded as interest income.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(continued)