BMW 2001 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2001 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196

|

|

94

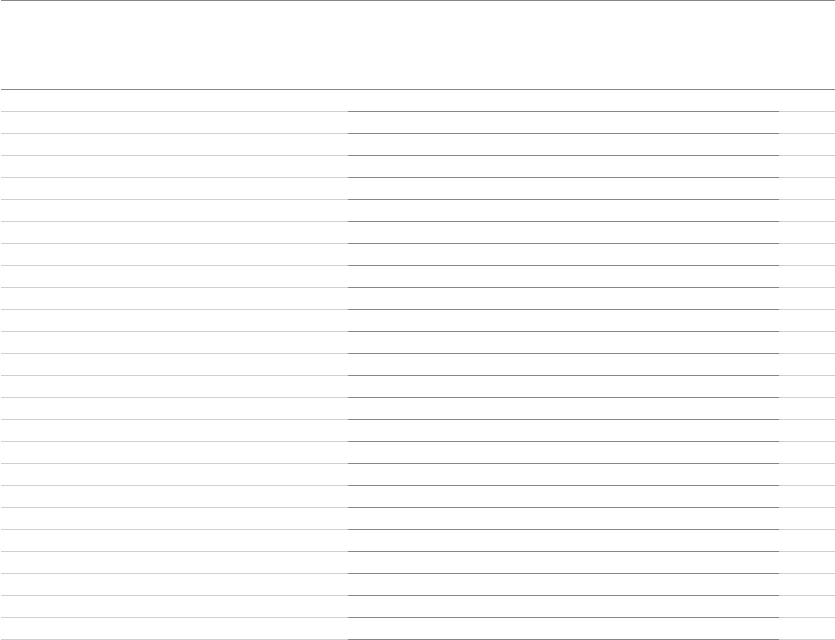

These interest rates, were adjusted where nec-

essary to take account of the credit quality and risk

of the underlying financial instrument.

The nominal amounts of derivative financial in-

struments are the purchase or sales amount or value

In accordance with internal guidelines, the nom-

inal amounts correspond to the volume of hedged

items.

The disclosed fair values of derivative financial

instruments do not take account of any compensat-

of the underlying transactions. The nominal

amounts, fair values (and also carrying amounts) and

maturities of derivative financial instruments of the

BMW Group are shown in the following analysis:

ing changes in value of the underlying transaction.

Moreover, the fair values disclosed do not necessari-

ly correspond to the amounts which the BMW

Group will realise in the future under the market con-

ditions prevailing at that time.

001 BMW Group in figures

004 Report of the Supervisory Board

008 Supervisory Board

011 Board of Management

012 Group Management Report

029 BMW Stock

033 Group Financial Statements

098 BMW AG Financial Statements

104 BMW Group Annual Comparison

106 BMW Group Locations

108 Glossary

112 Index

in euro million Nominal- Fair values

amount

Total within between 1 later than

1 year and 5 years 5 years

31. December 2001

Assets

Currency hedge contracts 5,631 783 742 41

Interest rate contracts 5,337 67 58 7 2

Other derivative financial instruments 531 142 1 78 63

Total 11,499 992 801 126 65

Liabilities

Currency hedge contracts 21,825 1,531 981 530 20

Interest rate contracts 16,057 378 163 178 37

Total 37,882 1,909 1,144 708 57

31. December 2000

Assets

Currency hedge contracts 4,228 278 114 164

Interest rate contracts 4,527 137 8 85 44

Total 8,755 415 122 249 44

Liabilities

Currency hedge contracts 21,174 1,431 791 640

Interest rate contracts 14,228 151 11 105 35

Total 35,402 1,582 802 745 35