BMW 2001 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2001 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

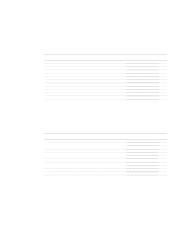

Income taxes comprise the following:

The expense for current tax includes tax pay-

ments relating to prior years, net of tax reimburse-

ments, of euro 24 million (2000: net tax reimburse-

ment of euro 22 million). No taxes arose in

conjunction with extraordinary items or from the dis-

continuation of operations in the year under report.

There were no changes in accounting policies as

defined by IAS 8 (Net Profit or Loss for the Period,

Fundamental Errors and Changes in Accounting

Policies) in the past and thus no impact on the tax

expense.

Deferred taxes are computed using tax rates

based on laws already enacted in the various tax

jurisdictions or using rates that are expected to apply

at the date when the amounts are paid or recovered.

Following the tax reform in Germany which became

effective on1 January 2001, the income tax rates for

retained profits (previously 40%) and for distributed

profits (previously 30%) were reduced to a uniform

level of 25%. Including the average effective mu-

nicipal trade tax rate of 12.5% and the solidarity sur-

charge of 5.5%, the overall tax rate for BMW compa-

nies in Germany is 38.9% (in 2000: 52.0%). The tax

rates for companies outside Germany range from

10% to 42.5%. The deferred tax expense was re-

duced by euro 10 million (2000: increased by euro

225 million) as a result of changes in the tax rates.

Deferred taxes were not recognised on non-dis-

tributed profits of euro 7.9 billion (2000: euro 6.5 bil-

lion) of foreign subsidiaries, as it is intended to invest

these profits to maintain and expand the business

volume. A computation was not made of the poten-

tial impact on the income taxes on the grounds of

disproportionate expense.

Following a change to IAS 12 in 2000, it is only

permitted to recognise deferred taxes on the poten-

tial reduction of income taxation once the share-

holders have formally resolved to pay a dividend.The

effect of this change on the Group financial state-

ments at 31 December 2000 was immaterial.

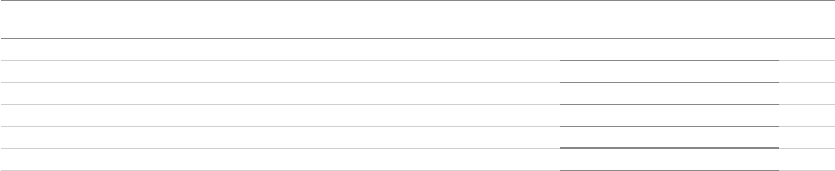

Deferred tax assets and liabilities at 31 Decem-

ber were attributable to the following positions:

001 BMW Group in figures

004 Report of the Supervisory Board

008 Supervisory Board

011 Board of Management

012 Group Management Report

029 BMW Stock

033 Group Financial Statements

098 BMW AG Financial Statements

104 BMW Group Annual Comparison

106 BMW Group Locations

108 Glossary

112 Index

[14]Income taxes

in euro million 2001 2000

Current tax 678 425

Deferred tax 698 398

1,376 823