Avon 2009 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2009 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

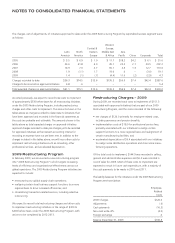

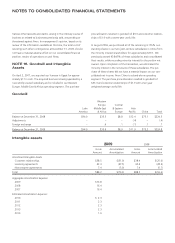

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

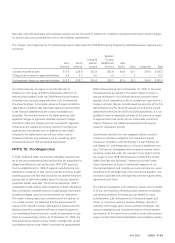

Various other lawsuits and claims, arising in the ordinary course of

business or related to businesses previously sold, are pending or

threatened against Avon. In management’s opinion, based on its

review of the information available at this time, the total cost of

resolving such other contingencies at December 31, 2009, should

not have amaterial adverse effect on our consolidated financial

position, results of operations or cash flows.

NOTE 16. Goodwill and Intangible

Assets

On April 2, 2007, we acquired our licensee in Egypt for approx-

imately $17 in cash. The acquired business is being operated by a

new wholly-owned subsidiary and is included in our Western

Europe, Middle East &Africa operating segment. The purchase

price allocation resulted in goodwill of $9.3 and customer relation-

ships of $1.0 with aseven-year useful life.

In August 2006, we purchased all of the remaining 6.155% out-

standing shares in our two joint-venture subsidiaries in China from

the minority interest shareholders for approximately $39.1. We

previously owned 93.845% of these subsidiaries and consolidated

their results, while recording minority interest for the portion not

owned. Upon completion of the transaction, we eliminated the

minority interest in the net assets of these subsidiaries. The pur-

chase of these shares did not have amaterial impact on our con-

solidated net income. Avon China is astand-alone operating

segment. The purchase price allocation resulted in goodwill of

$33.3 and customer relationships of $1.9 with aten-year

weighted-average useful life.

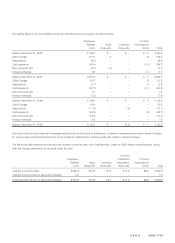

Goodwill

Latin

America

Western

Europe,

Middle East

&Africa

Central

&Eastern

Europe

Asia

Pacific China Total

Balance at December 31, 2008 $94.9 $33.3 $8.8 $12.4 $75.1 $224.5

Adjustments –––(.4) –(.4)

Foreign exchange –.6.1(.1) .1 .7

Balance at December 31, 2009 $94.9 $33.9 $8.9 $11.9 $75.2 $224.8

Intangible assets

2009 2008

Gross

Amount

Accumulated

Amortization

Gross

Amount

Accumulated

Amortization

Amortized Intangible Assets

Customer relationships $38.5 $(31.0) $38.4 $(25.6)

Licensing agreements 42.3 (37.5) 42.4 (28.3)

Noncompete agreements 7.4 (5.9) 7.4 (5.7)

Total $88.2 $(74.4) $88.2 $(59.6)

Aggregate Amortization Expense:

2009 $14.8

2008 16.4

2007 16.4

Estimated Amortization Expense:

2010 $2.3

2011 2.3

2012 2.3

2013 2.3

2014 1.6