Avon 2009 Annual Report Download - page 37

Download and view the complete annual report

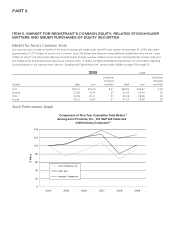

Please find page 37 of the 2009 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT'S DISCUSSION

AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF

OPERATIONS

You should read the following discussion of the results of oper-

ations and financial condition of Avon Products, Inc. and its

majority and wholly owned subsidiaries in conjunction with the

information contained in the Consolidated Financial Statements

and related Notes. When used in this discussion, the terms

“Avon,” “Company,” “we,” “our” or “us” mean, unless the

context otherwise indicates, Avon Products, Inc. and its majority

and wholly owned subsidiaries.

Refer to the Key Performance Indicators table on page 23 of this

2009 Annual Report for adescription of how Constant dollar

(“Constant $”) growth rates (a Non-GAAP financial measure)

are determined.

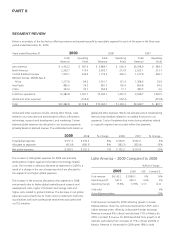

OVERVIEW

We are aglobal manufacturer and marketer of beauty and

related products. Our business is conducted worldwide, primarily

in the direct-selling channel. We presently have sales operations

in 65 countries and territories, including the U.S., and distribute

products in 40 more. Our reportable segments are based on

geographic operations in six regions: Latin America; North Amer-

ica; Central &Eastern Europe; Western Europe, Middle East &

Africa; Asia Pacific; and China. We have centralized operations

for Global Brand Marketing, Global Sales and Supply Chain. Our

product categories are Beauty, Fashion and Home. Beauty con-

sists of color cosmetics, fragrances, skin care and personal care.

Fashion consists of fashion jewelry, watches, apparel, footwear

and accessories. Home consists of gift and decorative products,

housewares, entertainment and leisure products and children’s

and nutritional products. Sales from Health and Wellness prod-

ucts and mark.,aglobal cosmetics brand that focuses on the

market for young women, are included among these three cate-

gories based on product type. Sales are made to the ultimate

consumer principally through direct selling by approximately

6.2 million active independent Representatives, who are inde-

pendent contractors and not our employees. The success of our

business is highly dependent on recruiting, retaining and servic-

ing our Representatives.

We view the geographic diversity of our businesses as astrategic

advantage in part because it allows us to participate in higher

growth beauty markets internationally. In developed markets,

such as the U.S., we seek to achieve growth in line with that of

the overall beauty market, while in developing and emerging

markets, we seek to achieve higher growth targets. During 2009,

approximately 80% of our consolidated revenue was derived

fromoperations outside the U.S.

At the end of 2005, we launched acomprehensive, multi-year

turnaround plan to restore sustainable growth. We have approved

and announced all of the initiatives of the restructuring program

launched in 2005 under the turnaround plan (“2005 Restructur-

ing Program”). In 2007, we completed theanalysis of our optimal

product portfolio and made decisions on exit strategies for

non-optimal products under our Product Line Simplification pro-

gram (“PLS”). In 2007, we also launched our Strategic Sourcing

Initiative (“SSI”). We expect our restructuring initiatives under our

2005 Restructuring Program to deliver annualized savings of

approximately $430 once all initiatives are fully implemented by

2011-2012. We also expect to achieve annualized benefits in

excess of $200 from PLS and $250 from SSI in 2010. In February

2009, we announced anew restructuring program (“2009

Restructuring Program”) under our multi-year turnaround plan,

which targets increasing levels of efficiency and organizational

effectiveness across our global operations. We expect therestruc-

turing initiatives under our 2009 Restructuring Program to deliver

annualized savings of approximately $200 once all initiatives are

fully implemented by 2012-2013. These initiatives and programs

are discussed further below. Whenever we refer to annualized

savings or annualized benefits, we mean the additional operating

profit we expect to realize on afull-year basis every year follow-

ing implementation of the respective initiative as compared with

the operating profit we would have expected to achieve without

having implemented the initiative.

During 2009, revenue decreased 3%, impacted by unfavorable

foreign exchange and the depressed global economy. Constant

$revenue increased 6%, with increases in all segments except

North America and China. Sales from products in the Beauty

category decreased 3%, due to unfavorable foreign exchange.

On aConstant $basis, sales of products in the Beauty category

increased 7% due to a4%increase in units and a3%increase

in net per unit. Active Representatives increased 9%. The unfav-

orable impact of foreign exchange lowered operating margin by

an estimated 2.5 points (approximately 2points from foreign-

exchange transactions and approximately 0.5 points from foreign-

exchange translation), year over year. See the “Segment Review”

section of this MD&A for additional information related to

changes in revenue by segment.

Although we expect that the global economic pressures will

continue in the foreseeable future, we expect at least mid-single

digit Constant $revenue growth during 2010.

Our 2010 operating margin will be negatively impacted by the

devaluation of the Venezuelan currency coupled with arequired

change to account for operations in Venezuela on ahighly

inflationary basis.Asaresult of thedevaluation, we expect the

Company’s operating margin to be negatively impacted by

approximately $85 of costs associated with the historical cost in

AVON2009 19