Avon 2009 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2009 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

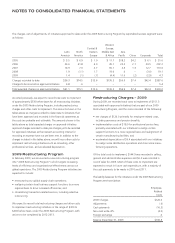

Restructuring Charges –2007

During 2007 and January 2008, exit and disposal activities that

are apart of our 2005 Restructuring Program were approved.

Specific actions for this phase of our multi-year restructuring

plan included:

•the reorganization of certain functions, primarily sales-related

organizations;

•the restructure of certain international direct-selling operations;

•the realignment of certain of our distribution and manufacturing

operations, including the realignment of certain of our Latin

America distribution operations;

•automation of certain distribution processes; and

•outsourcing of certain finance, customer service, and

information technology processes.

The outsourcing of some information technology processes and

the realignment of some Latin America distribution operations

are expected to be completed by the end of 2011. All other

actions described above were completed by the end of 2009.

During 2007, we recorded total costs to implement in 2007 of

$158.3 associated with our 2005 Restructuring Program, and the

costs consisted of the following:

•charges of $118.0 for employee-related costs, including

severance, pension and other termination benefits;

•favorable adjustments of $8.0, primarily relating to certain

employees pursuing reassignments to other positions and

higher than expected turnover (employees leaving prior to

termination); and

•other costs to implement of $48.3 forprofessional service fees

associated with our initiativestooutsource certain human

resource, finance, customer service, and information technology

processes and accelerated depreciation associated with our

initiatives to realign certain distribution operations and close

certainmanufacturing operations.

Of the total costs to implement, $157.3 was recorded in selling,

general and administrative expenses and $1.0 was recorded in

cost of sales in 2007.

Approximately 95% of these charges are expected to result in

future cash expenditures, with amajority of the cash payments

made during 2009.

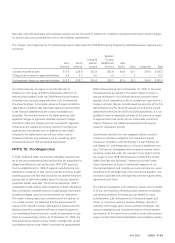

Restructuring Charges –2008

During 2008, we recorded total costs to implement $60.6

associated with previously approved initiatives that are part of

our 2005 Restructuring Program, and the costs consisted of the

following:

•net charges of $19.1 primarily for employee-related costs,

including severance and pension benefits;

•implementation costs of $30.5 for professional service fees,

primarily associated with our initiatives to outsource certain

finance and human resource processes; and

•accelerated depreciation of $11.0 associated with our initiatives

to realign some distribution operations and close some

manufacturing operations.

Of the total costs to implement, $57.5 was recorded in selling,

general and administrative expenses and $3.1 was recorded in

cost of sales for 2008.

Restructuring Charges –2009

During 2009, we recorded total costs to implement of $20.1

associated with previously approved initiatives that are part of

our 2005 Restructuring Program, and the costs consisted of

the following:

•net charges of $4.7 primarily for employee-related costs,

including severance and pension benefits;

•implementation costs of $9.6 for professional service fees,

primarily associated with our initiatives to outsource certain

finance processes and realign certain distribution operations;

and

•accelerated depreciation of $5.8 associated with our initiatives

to realign some distribution operations.

Of the total costs to implement, $19.8 was recorded in selling,

general and administrative expenses and $.3 was recorded in

cost of sales for 2009.