Avon 2009 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2009 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

The decrease in operating margin for 2009 was primarily driven

by unfavorable foreign exchange, including the impacts of

foreign exchange transactions as well as translation, which

negatively impacted operating margin by an estimated 3points.

Additionally, higher costs to implement restructuring initiatives

negatively impacted operating margin by .7 points, as these costs

impacted 2009 operating margin by 2.5 points as compared to 1.8

points in 2008. Partially offsetting these unfavorable items were

lower overhead expenses in 2009.

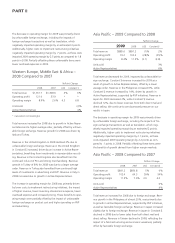

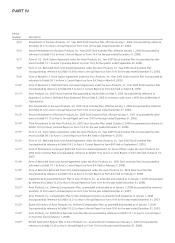

Western Europe, Middle East &Africa –

2008 Compared to 2007

%/Point Change

2008 2007 US$ Constant $

Total revenue $1,351.7 $1,308.6 3% 6%

Operating profit 121.0 33.9 **

Operating margin 8.9% 2.6% 6.3 6.8

Units sold (3)%

Active Representatives 4%

*Calculation not meaningful

Total revenue increased for 2008 due to growth in Active Repre-

sentatives and ahigher average order, partially offset by unfavor-

able foreign exchange. Revenue growth for 2008 was driven by

Italy and Turkey.

Revenue in the United Kingdom in 2008 declined 3% due to

unfavorable foreign exchange. Revenue in the United Kingdom

in Constant $increased, driven by an increase in Active Repre-

sentatives, benefiting from investments in representative recruit-

ing. Revenue in the United Kingdom also benefited from the

continued roll-out of PLS and strong merchandising. Revenue

growth in Turkey of 8% for 2008 was due to alarger average

order. Revenue in Turkey also benefited from continued high

levels of investments in advertising and RVP. Revenue in Italy in

2008 increased due to growth in Active Representatives.

The increase in operating margin for 2008 was primarily driven

by lower costs to implement restructuring initiatives, the impact

of higher revenue, lower inventory obsolescence expense, lower

overhead expenses and increased pricing. These benefits to oper-

ating margin were partially offset by the impact of unfavorable

foreign exchange on product cost and higher spending on RVP

and advertising.

Asia Pacific –2009 Compared to 2008

%/Point Change

2009 2008 US$ Constant $

Total revenue $885.6 $891.2 (1)% 2%

Operating profit 74.2 102.4 (28)% (25)%

Operating margin 8.4% 11.5% (3.1) (2.8)

Units sold 3%

Active Representatives 6%

Total revenue decreased for 2009, impacted by unfavorable for-

eign exchange. Constant $revenue increased for 2009 as a

result of growth in Active Representatives, offset by alower

average order. Revenue in the Philippines increased 6%, while

Constant $revenue increased by 14%, driven by growth in

Active Representatives, supported by RVP initiatives. Revenue in

Japan for 2009 decreased 2%, while Constant $revenue

declined 12%, due to lower revenues from both direct mail and

direct selling. We continue to see downward pressure on our

results in Japan.

The decrease in operating margin for 2009 was primarily driven

by unfavorable foreign exchange, including the impacts of for-

eign exchange transactions as well as translation, which neg-

atively impacted operating margin by an estimated 2points.

Additionally, higher costs to implement restructuring initiatives

negatively impacted operating margin by 2.1 points, as these

costs impacted 2009 operating margin by 2.2 points as com-

pared to .1 points in 2008. Partially offsetting these items were

the benefits of growth derived from higher margin markets.

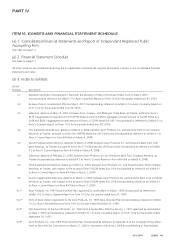

Asia Pacific –2008 Compared to 2007

%/Point Change

2008 2007 US$ Constant $

Total revenue $891.2 $850.8 5% 0%

Operating profit 102.4 64.3 59% 54%

Operating margin 11.5% 7.6% 3.9 4.0

Units sold 0%

Active Representatives 4%

Total revenue increased for 2008 due to foreign exchange. Reve-

nue growth in the Philippines of almost 20%, was primarily due

to growth in Active Representatives, supported by RVP initiatives,

as well as favorable foreign exchange. Revenue in Japan increased

slightly due to foreign exchange. Revenue in Japan in Constant $

declined in 2008 due to lower sales from both direct mail and

direct selling. Revenue in Taiwan declined in 2008, reflecting the

impact of afield restructuring and economic weakness, partially

offset by favorable foreign exchange.