Avon 2009 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2009 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

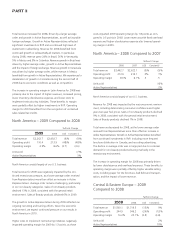

Constant $and U.S. dollars. Revenue in Venezuela will be

negatively impactedinfuture periods by the change in the official

exchange ratediscussed below.

Constant $revenue growth in Brazil for 2009 was primarily

driven by an increase in Active Representatives, as well as ahigher

average order. Constant $revenue growth in Mexico for 2009

was driven by asignificant increase in Active Representatives,

partially offset by alower average order, reflecting adifficult

economic climate. Revenue growth in Venezuela for2009 reflected

increased prices due to inflation.

The decrease in operating margin in Latin America for 2009 was

primarily due to an estimated 2point negative impact of unfavor-

able foreign exchange transactions, which includes the cost of

our Venezuelan subsidiary settling certain U.S. dollar-denominated

liabilities through transactions with non-government sources

where the exchange rate is less favorable than the official rate

(the “parallel market”). Additionally, higher costs to implement

restructuring initiatives during 2009 negatively impacted operating

margin by 0.7points, as thesecosts impacted operating margin by

0.9 points in 2009 and 0.2 points in 2008. Partially offsetting

these negative impacts was the benefit of higher revenues and

fixed overhead expense.

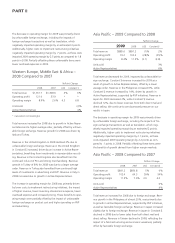

Currency restrictions enacted by the Venezuelan government in

2003 have impacted the ability of our subsidiary in Venezuela

(“Avon Venezuela”) to obtain foreign currency at the official rate

to pay for imported products. Unless official foreign exchange is

made more readily available, Avon Venezuela’s operations will

continue to be negatively impacted as it will need to obtain more

of its foreign currency needs from the parallel market. During

2009, the exchange rate in the parallel market generally aver-

aged from 5to6bolivars to the U.S. dollar, compared to the

official rate of 2.15 during 2009.

At December 31, 2009, Avon Venezuela had cash balances of

approximately $104 translated at the December 31, 2009 official

rate, of which approximately $83 was denominated in bolivars

and $21 was denominated in U.S. dollars. The last dividends

repatriated to the U.S. were during 2007, when Avon Venezuela

remitted dividends of approximately $40 at the official exchange

rate. Avon Venezuela continues to receive official foreign exchange

for some of its imports and other remittances. In 2009, we

continued to use the official rate to translate the financial state-

ments of Avon Venezuela into U.S. dollars. During 2009, Avon

Venezuela’s revenue and operating profit represented approx-

imately 5% and 9% of Avon’s consolidated revenue and Avon’s

consolidated operating profit, respectively.

Inflation in Venezuela has been at high levels over the past few

years. Avon uses the blended Consumer Price Index and National

Consumer Price Index to determine whether Venezuela is a

highly inflationary economy. Effective with the beginning of its

2010 fiscal year, Avon will treat Venezuela as ahighly inflationary

economy for accounting purposes. When an entity operates in a

highly inflationary economy, exchange gains and losses associated

with monetary assets and liabilities and deferred income taxes

resulting from changes in the exchange rate are recorded in

income. Nonmonetary assets, which include inventories and

property, plant and equipment, are carried forward at their

historical dollar cost.

Effective January 11, 2010, the Venezuelan government devalued

its currency and moved to atwo-tier exchange structure. The

official exchange rate moved from 2.15 to 2.60 for essential

goods and to 4.30 fornon-essential goods and services. Although

no official rules have yet been issued, most of Avon’s imports are

expected to fall into the non-essential classification. As aresult

of the change in the official rate to 4.30, Avon anticipates it will

record aone-time, after-tax loss of approximately $50 million in

the first quarter of 2010, primarily reflecting the write-down of

monetary assets and deferred tax benefits. Additionally, certain

nonmonetary assets are carried at historic dollar cost subsequent

to the devaluation. Therefore, these costs will impact the income

statement during 2010 as they will not be devalued based on

the new exchange rates, but will be expensed at the historic

dollar value. As aresult of using the historic dollar cost basis of

nonmonetary assets acquired prior to the devaluation, such as

inventory, 2010 operating profit and net income will additionally

be negatively impacted by approximately $85 million, primarily

during the first half of the year, for the difference between the

historical cost at the previous official exchange rate of 2.15 and

the new official exchange rate of 4.30. In addition, revenue and

operating profit for Avon’s Venezuela operations will be neg-

atively impacted when translated into dollars at the new official

exchange rate. This would be partially offset by the favorable

impact of any operating performance improvements. Results for

periods prior to 2010 will not be impacted by the change in

accounting treatment of Venezuela as ahighly inflationary

economy or by the change in the official rate in January of 2010.

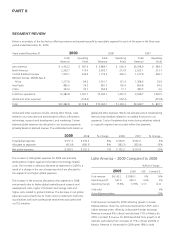

Latin America –2008 Compared to 2007

%/Point Change

2008 2007 US$ Constant $

Total revenue $3,884.1 $3,298.9 18% 14%

Operating profit 690.3 483.1 43% 38%

Operating margin 17.8% 14.6% 3.2 3.0

Units sold 4%

Active Representatives 6%

AVON2009 29