Avon 2009 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2009 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

agreement of $1.9 was recorded in AOCI and is being amortized

to interest expense over five years.

During 2003, we entered into treasury lock agreements that we

designated as cash flow hedges and used to hedge the exposure

to the possible rise in interest rates prior to the issuance of the

4.625% Notes. The loss of $2.6 was recorded in AOCI and is

being amortized to interest expense over ten years.

AOCI included remaining unamortized losses of $28.8 ($18.7 net

of taxes) at December 31, 2009, and $35.2 ($22.9 net of taxes)

at December 31, 2008, resulting from treasury lock agreements.

Foreign Currency Risk

The primary currencies forwhich we have net underlying foreign

currencyexchange rate exposures are theArgentine peso, Brazilian

real, British pound, Canadian dollar, Chinese renminbi, Colombian

peso, theeuro, Japanese yen, Mexican peso, Philippine peso, Polish

zloty, Russian ruble, Turkish lira, Ukrainian hryvnia and Venezuelan

bolivar. We use foreign exchange forward contracts to manage a

portion of our foreign currency exchange rate exposures. At

December 31, 2009, we had outstanding foreign exchange forward

contracts with notional amounts totaling approximately $285.2 for

the euro, the Hungarian forint, thePeruvian new sol, the Czech

Republickoruna, theRomanian leu, theCanadian dollar, the

Australian dollar, the NewZealand dollar, the Polish zloty and the

British pound.

We use foreign exchange forward contracts to hedge portions

of our forecasted foreign currency cash flows resulting from

intercompany royalties, and other third-party and intercompany

foreign currency transactions where there is ahigh probability

that anticipated exposures will materialize. These contracts have

been designated as cash flow hedges. The effective portion of

the gain or loss on the derivative is recorded in accumulated

other comprehensive income to the extent effective and reclas-

sified into earnings in the same period or periods during which

the transaction hedged by that derivative also affects earnings.

The ineffective portion of the gain or loss on the derivative is

recorded in other expense, net. The ineffective portion of our

cash flow foreign currency derivative instruments and the net

gains or losses reclassified from AOCI to earnings for cash flow

hedges that had been discontinued because the forecasted

transactions were not probable of occurring were not material.

As of December 31, 2009, we expect to reclassify $18.8, net of

taxes, of net losses on derivative instruments designated as cash

flow hedges from AOCI to earnings during the next 12 months

due to (a) foreign currency denominated intercompany royalties,

(b) intercompany loan settlements and (c) foreign currency

denominated purchases or receipts.

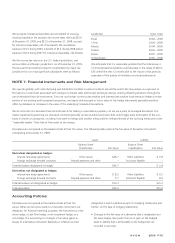

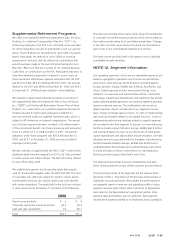

For the years ended December 31, 2009 and 2008, cash flow

hedges impacted AOCI as follows:

2009 2008

Net derivative losses at beginning of year,

net of taxes of $14.8 and $9.7 $(27.2) $(17.7)

Net gains on derivative instruments,

net of taxes of $2.4 and $8.4 31.0 20.3

Reclassification of net gains to earnings,

net of taxes of $7.1 and $3.3 (22.6) (29.8)

Net derivative losses at end of year,

net of taxes of $10.1 and $14.8 $(18.8) $(27.2)

We also use foreign exchange forward contracts to manage for-

eign currency exposure of intercompany loans. These contracts

are not designated as hedges for financial reporting purposes.

The change in fair value of these contracts is immediately recog-

nized in earnings and substantially offsets the foreign currency

impact recognized in earnings relating to the intercompany

loans. During 2009, we recorded again of $8.3 in other

expense, net related to these undesignated foreign exchange

forward contracts. Also during 2009, we recorded aloss of $2.9

related to the intercompany loans, caused by changes in foreign

currency exchange rates.

We have used foreign exchange forward contracts and foreign

currency-denominated debt to hedge the foreign currency

exposure related to the net assets of aforeign subsidiary. Aloss

of $1.6 on the foreign currency-denominated debt was effective

as ahedge of the net assets of the foreign subsidiary and was

recorded in accumulated other comprehensive income. During

2009, we had aJapanese yen-denominated note payable to

hedge our net investment in our Japanese subsidiary. This debt

was repaid in 2009. $23.8 for 2009, $33.6 for 2008 and $9.7

for 2007, related to the effective portions of these hedges were

included in foreign currency translation adjustments within AOCI

on the Consolidated Balance Sheets. During 2009, the ineffec-

tive portion of the loss was $.3 on the foreign currency-denom-

inated debt and was recorded in other expense, net.

Credit and Market Risk

We attempt to minimize our credit exposure to counterparties by

entering into interest rate swap and foreign currency forward

rate and option agreements only with major international finan-

cial institutions with “A” or higher credit ratings as issued by

Standard &Poor’s Corporation. Our foreign currency and inter-

est rate derivatives are comprised of over-the-counter forward

contracts, swaps or options with major international financial

institutions. Although our theoretical credit risk is the replace-

ment cost at the then estimated fair value of these instruments,

AVON2009 F-17