Avon 2009 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2009 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.brand equity. We own the material patents and trademarks used

in connection with the marketing and distribution of our major

products both in the U.S. and in other countries where such

products are principally sold. Although most of our material

intellectual property is registered in the U.S. and in certain for-

eign countries in which we operate, there can be no assurance

with respect to the rights associated with such intellectual prop-

erty in those countries. In addition, the laws of certain foreign

countries, including many emerging markets, such as China, may

not protect our intellectual property rights to the same extent as

the laws of the U.S. The costs required to protect our patents

and trademarks may be substantial.

We are involved, and may become involved

in the future, in legal proceedings that, if

adversely adjudicated or settled, could

adversely affect our financial results.

We are and may, in the future, become party to litigation. In

general, litigation claims can be expensive and time consuming

to bring or defend against and could result in settlements or

damages that could significantly affect financial results. We are

currently vigorously contesting certain of these litigation claims.

However, it is not possible to predict the final resolution of the

litigation to which we currently are or may in the future become

party to, and the impact of certain of these matters on our

business, results of operations and financial condition could

be material.

Government reviews, inquiries,

investigations, and actions could harm our

business or reputation.

As we operate in various locations around the world, our oper-

ations in certain countries are subject to significant governmental

scrutiny and may be harmed by the results of such scrutiny. The

regulatory environment with regard to direct selling in emerging

and developing markets where we do business is evolving, and

officials in such locations often exercise broad discretion in

deciding how to interpret and apply applicable regulations. From

time to time, we may receive formal and informal inquiries from

various government regulatory authorities about our business

and compliance with local laws and regulations. Any determi-

nation that our operations or activities, or the activities of our

Representatives, are not in compliance with existing laws or

regulations could result in the imposition of substantial fines,

interruptions of business, termination of necessary licenses and

permits, or similar results, all of which could potentially harm our

business and/or reputation. Even if an inquiry does not result in

these types of determinations, it potentially could create neg-

ative publicity which could harm our business and/or reputation.

Significant changes in pension fund

investment performance, assumptions

relating to pension costs or required legal

changes in pension funding rules may have

amaterial effect on the valuation of pension

obligations, the funded status of pension

plans and our pension cost.

Our funding policy for pension plans is to accumulate plan assets

that, over the long run, will approximate the present value of

projected benefit obligations. Our pension cost is materially

affected by the discount rate used to measure pension obliga-

tions, the level of plan assets available to fund those obligations

at the measurement date and the expected long-term rate of

return on plan assets. Significant changes in investment perfor-

mance or achange in the portfolio mix of invested assets can

result in corresponding increases and decreases in the valuation

of plan assets, particularly equity securities, or in achange of the

expected rate of return on plan assets. Achange in the discount

rate would result in asignificant increase or decrease in the

valuation of pension obligations, affecting the reported funded

status of our pension plans as well as the net periodic pension

cost in the following fiscal years. Similarly, changes in theexpected

return on plan assets can result in significant changes in the net

periodic pension cost of the following fiscal years. Finally, recent

pension funding requirements under the Pension Protection Act

of 2006 may result in asignificant increase or decrease in the

valuation of pension obligations affecting the reported funded

status of our pension plans.

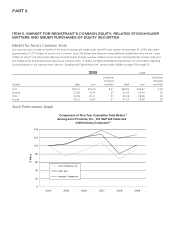

The market price of our common stock

could be subject to fluctuations as aresult

of many factors.

Factors that could affect the trading price of our common stock

include the following:

•variations in operating results;

•economic conditions and volatility in the financial markets;

•announcements or significant developments in connection

with our business and with respect to beauty and related

products or the beauty industry in general;

•actual or anticipated variations in our quarterly or annual

financial results;

•governmental policies and regulations;

•estimates of our future performance or that of our com-

petitors or our industries;

•general economic, political, and market conditions; and

•factors relating to competitors.

The trading price of our common stock has been, and could in

the future continue to be, subject to significant fluctuations.

AVON2009 13