Air New Zealand 2011 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2011 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

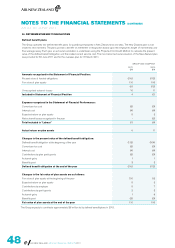

27. RELATED PARTIES (CONTINUED)

The Company has undertaken finance and operating lease arrangements with its wholly owned subsidiary, Air New Zealand Aircraft

Holdings Limited, relating to its aircraft. Lease expense of $264 million was recognised by the Company during the year (30 June 2010:

$286 million).

Related party balances have no fixed settlement dates and are unsecured. Non-current amounts owing to subsidiaries (as shown in

Note 19) reflect deposits held in respect of capital investments. Certain balances are non-interest bearing and the remainder are

subject to interest at current floating rates. For balances outstanding at year end refer to Notes 9 and 19. Provisions for doubtful debts

of $106 million were held by the Company against outstanding balances from subsidiaries (30 June 2010: $106 million).

The Company has provided guarantees of financial indebtedness to Air New Zealand Aircraft Holdings Limited of $1,255 million

(30 June 2010: $1,075 million).

As at 30 June 2011, the Company has guaranteed the obligations of Air New Zealand Aircraft Holdings Limited and New Zealand

International Airlines Limited under aircraft operating lease arrangements amounting to $866 million (30 June 2010: $1,385 million),

and property lease obligations of subsidiaries of $10 million (30 June 2010: $13 million).

The Company guarantees aircraft end of lease obligations of Air New Zealand Aircraft Holdings Limited and New Zealand International

Airlines Limited.

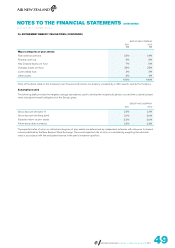

The Group has a set-off arrangement on certain Bank of New Zealand balances, allowing the offset of overdraft amounts against

in-fund amounts. Interest is earned (or accrued) by Air New Zealand Limited based on the net position across the Group. This interest is

not allocated to subsidiary companies. The following entities are included in the set-off arrangement:

Air Nelson Limited

Air New Zealand Holidays Limited

Air New Zealand Limited

Eagle Airways Limited

Mount Cook Airlines Limited

Safe Air Limited

Associates

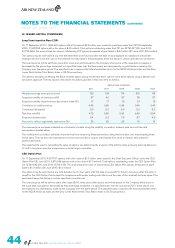

Transactions between Air New Zealand and its associates were as follows:

GROUP

2011

$M

GROUP

2010

$M

COMPANY

2011

$M

COMPANY

2010

$M

Operating revenue 5 5 - -

Operating expenditure (25) (14) - -

Included within Operating expenditure (“Other expenses”) are the

following amounts:

Provision for impairment in investment 1 2 - -

Reversal of provision for impairment in investment - (1) - -

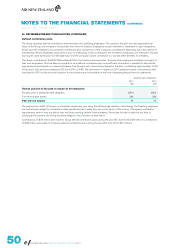

During the year the Group engaged the Christchurch Engine Centre (CEC) to provide maintenance services on certain V2500 engines.

In addition the Group provides certain administration services to CEC. Amounts outstanding at the end of the year are disclosed within

Note 19.

On 30 June 2010 an investment in Travel Software Solutions Pty Limited was sold for $2. Prior to disposal, share capital of $2 million

was repaid.

During the year ended 30 June 2011, an impairment provision of $3 million was recognised against the investment in VCubed Pty

Limited (30 June 2010: $2 million). The impairment was calculated using a value in use model with a discount rate of 30% being

applied (30 June 2010: 30%).

Other related party disclosures

Other balances and transactions with related parties are not considered material to Air New Zealand and are entered into in the normal

course of business on standard commercial terms. There have been no related party debts forgiven during the year.

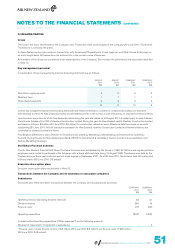

28. SUBSEQUENT EVENT

Air New Zealand announced on 19 August 2011 that it was considering making an offer to the public in New Zealand of up to $150

million of unsecured, unsubordinated fixed rate bonds. The bonds (if issued) will have a maturity date of 15 November 2016.

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

AS AT 30 JUNE 2011

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 2011