Air New Zealand 2011 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2011 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

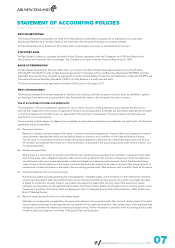

LEASE PAYMENTS

Operating leases

Leases under which a significant proportion of the risks and rewards of ownership are retained by the lessor are classified as operating

leases. Payments made under operating leases (net of any incentives received) are recognised as an expense in the Statement of

Financial Performance on a straight-line basis over the term of the lease.

Finance leases

Payments made under finance leases are apportioned between the finance expense and the reduction of the outstanding liability. The

finance expense is allocated to each period during the lease term so as to produce a constant periodic rate of interest on the remaining

balance of the liability.

MAINTENANCE COSTS

The cost of major engine overhauls for aircraft owned by the Group is capitalised and depreciated over the period to the next expected

inspection or overhaul.

Where there is a commitment to maintain aircraft held under operating lease arrangements, a provision is made during the lease term for the

lease return obligations specified within those lease agreements. The provision is based upon historical experience, manufacturers’ advice and,

where appropriate, contractual obligations in determining the present value of the estimated future costs of major airframe inspections and

engine overhauls by making appropriate charges to the Statement of Financial Performance, calculated by reference to the number of hours or

cycles operated during the year.

All other maintenance costs are expensed as incurred.

FINANCIAL INSTRUMENTS

Non-derivative financial instruments

Non-derivative financial instruments include cash and cash equivalents, trade and other receivables (excluding prepayments), other

interest-bearing assets, investment in quoted equity instruments, interest-bearing liabilities and trade and other payables. These are

recognised initially at fair value plus any directly attributable transaction costs. Subsequent to initial recognition, non-derivative financial

instruments are recognised as described below.

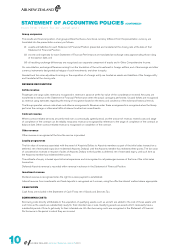

Financial Assets

Cash and cash equivalents

Cash and cash equivalents include cash on hand, demand deposits, current accounts in banks net of overdrafts and other short-term highly

liquid investments that are readily convertible to known amounts of cash and which are subject to an insignificant risk of changes in value.

Trade and other receivables

Trade and other receivables are recognised at cost less any provision for impairment. A provision for impairment is established when

collection is considered to be doubtful. When a trade receivable is considered uncollectible, it is written-off against the provision.

Other interest-bearing assets

Other interest-bearing assets are measured at amortised cost using the effective interest method, less any impairment.

Investment in quoted equity instruments

Changes in the fair value of investments in quoted equity instruments, including any related foreign exchange component, are

recognised through other comprehensive income where an irrevocable election has been made at inception to do so. This election

is made in order to ensure the appropriate representation of long-term, strategic investments as distinct from those held for trading.

Dividends from such investments are recognised in profit or loss when the right to receive payment has been established. The

cumulative gains or losses held in other comprehensive income are not transferred to profit or loss on derecognition or otherwise,

although they may be transferred within equity.

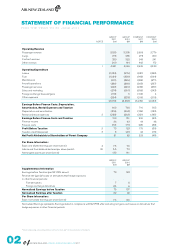

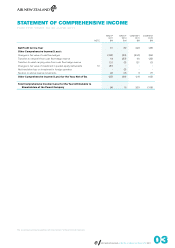

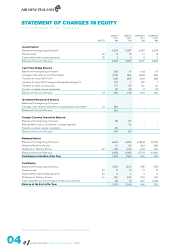

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 2011

STATEMENT OF ACCOUNTING POLICIES (CONTINUED)

FOR THE YEAR TO 30 JUNE 2011