Air New Zealand 2011 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2011 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

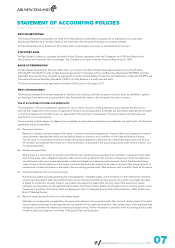

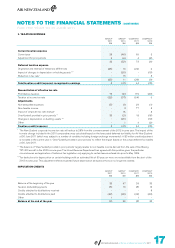

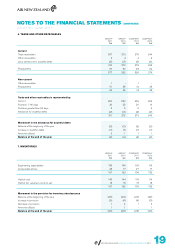

RESERVES

Cash flow hedge reserve

The cash flow hedge reserve comprises the effective portion of the cumulative net change in the fair value of cash flow hedging

instruments related to hedged transactions that have not yet occurred.

Foreign currency translation reserve

The foreign currency translation reserve comprises foreign exchange differences arising on consolidation of foreign operations together

with the translation of foreign currency borrowings designated as a hedge of net investments in those foreign operations.

Investment revaluation reserve

The equity investment reserve comprises changes in the fair value of the investment in quoted equity instruments.

FINANCIAL GUARANTEE CONTRACTS

Where the Company enters into financial guarantee contracts to guarantee the indebtedness of other companies within the Group, the

Company considers these to be insurance contracts (as defined by NZ IFRS 4 - Insurance contracts) and accounts for them as such.

TAXATION

The income taxation expense for the period is the taxation payable on the current period’s taxable income at tax rates enacted or

substantively enacted at reporting date. This is adjusted by changes in deferred taxation assets and liabilities. Income taxation expense

is recognised in the Statement of Financial Performance except where it relates to items recognised directly in equity, in which case it is

recognised in equity.

Deferred income taxation is provided in full, using the balance sheet liability method, on temporary differences arising between the

tax bases of assets and liabilities and their carrying amounts in the financial statements. Deferred income tax is determined using tax

rates (and laws) that have been enacted or substantively enacted by the balance sheet date and are expected to apply when the related

deferred income tax asset is realised or the deferred income tax liability is settled.

Deferred income tax assets and unused tax losses are only recognised to the extent that it is probable that future taxable amounts will

be available against which to utilise those temporary differences and losses.

EMPLOYEE BENEFITS

Pension obligations

Payments to defined contribution retirement plans are charged as an expense as they fall due. Payments made to multi-employer

retirement benefit schemes are treated in the same way as payments to defined contribution schemes where sufficient information is

not available to use defined benefit accounting.

Air New Zealand’s net obligation in respect of defined benefit pension plans is calculated separately for each plan by an independent

actuary, as being the present value of the future obligations to the members less the fair value of the plan’s assets, adjusted for any

unrecognised actuarial gains or losses and unrecognised past service costs. The discount rate reflects the yield on government bonds

that have maturity dates approximating the terms of Air New Zealand’s obligations. When the calculation results in a benefit to Air New

Zealand, the value of the asset recognised cannot exceed in aggregate the value of any unrecognised net actuarial losses and past

service cost, and the present value of any future refunds from the plan or reductions in future contributions to the plan.

Any actuarial gains or losses are amortised under the corridor method over the members’ expected average remaining working lives.

Share based compensation

All equity options are disclosed in the notes to the financial statements. The fair value (at grant date) of options granted to employees is

recognised as an expense, within the Statement of Financial Performance, over the vesting period of the options, with a corresponding

entry to Issued Capital. The amount recognised as an expense is adjusted at each reporting date to reflect the extent to which the

vesting period has expired and management’s best estimate of the number of share options that will ultimately vest.

Termination costs

Termination costs are recognised as an expense when the Group is demonstrably committed, without realistic possibility of withdrawal,

to a formal detailed plan to terminate employment before the normal retirement date.

PROVISIONS

A provision is recognised when the Group has a present legal or constructive obligation as a result of a past event, it is probable that an

outflow of economic benefits will be required to settle the obligation, and the provision can be reliably measured.

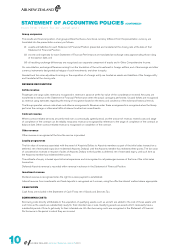

STATEMENT OF ACCOUNTING POLICIES (CONTINUED)

FOR THE YEAR TO 30 JUNE 2011

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 2011