Air New Zealand 2011 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2011 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

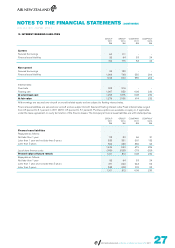

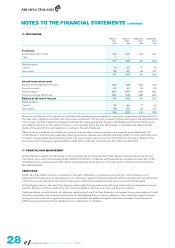

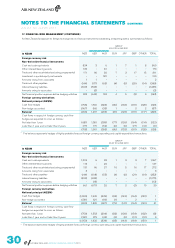

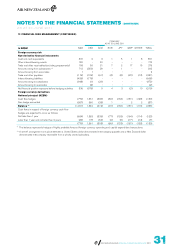

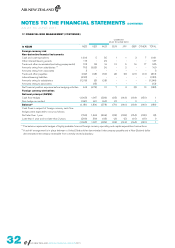

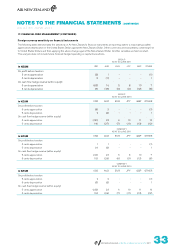

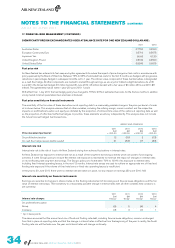

17. FINANCIAL RISK MANAGEMENT (CONTINUED)

COMPANY

AS AT 30 JUNE 2010

In NZ$M NZD USD AUD EUR JPY GBP OTHER TOTAL

Foreign currency risk

Non-derivative financial instruments

Cash and cash equivalents 1,009 5 35 1 1 3 7 1,061

Other interest-bearing assets 115 - 22 - - - - 137

Trade and other receivables (excluding prepayments) 123 58 16 10 5 16 17 245

Amounts owing from subsidiaries *** 763 (622) 26 - 2 - - 169

Amounts owing from associates 3------3

Trade and other payables (122) (98) (50) (4) (5) (21) (14) (314)

Interest-bearing liabilities (230) - - - - - - (230)

Amounts owing to subsidiaries (1,216) (2) (28) - - - - (1,246)

Amounts owing to associates - (13) - - - - - (13)

Net financial position exposure before hedging activities 445 (672) 21 7 3 (2) 10 (188)

Foreign currency derivatives

Notional principal (NZ$M)

Cash flow hedges (1,065) 1,947 (339) (85) (143) (164) (150) 1

Non-hedge accounted (561) 621 (60) (1) - 2 - 1

Balance** (1,181) 1,896 (378) (79) (140) (164) (140) (186)

Cash flows in respect of foreign currency cash flow

hedges were expected to occur as follows:

Not later than 1 year (769) 1,563 (296) (82) (138) (154) (132) (8)

Later than 1 year and not later than 2 years (296) 384 (43) (3) (5) (10) (18) 9

(1,065) 1,947 (339) (85) (143) (164) (150) 1

** The balance represents hedges of highly probable forecast foreign currency operating and capital expenditure transactions.

*** A set-off arrangement is in place between a United States dollar denominated intercompany payable and a New Zealand dollar

denominated intercompany receivable from a wholly owned subsidiary.

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

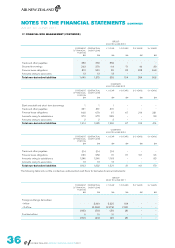

AS AT 30 JUNE 2011

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 2011