Air New Zealand 2011 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2011 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

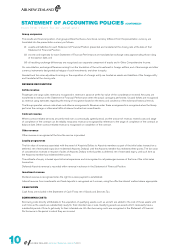

(e) Taxation

The preparation of the financial statements requires management to make estimates about items that are not known at balance

date or prior to the Group reporting its final result. These items may ultimately impact the amount of tax payable by the Group.

Judgements are also required about the application of income tax legislation. These judgements and assumptions are subject

to risk and uncertainty, hence there is a possibility that changes in circumstances will alter expectations, which may impact the

amount of deferred tax assets and deferred tax liabilities recognised in the Statement of Financial Position and the amount of

other tax losses and temporary differences not yet recognised. In such circumstances, some or all of the carrying amounts of

recognised deferred tax assets and liabilities may require adjustment, resulting in a corresponding credit or charge to the Statement

of Financial Performance. Further information is provided in the accounting policies under “Taxation”, Note 3 Taxation Expense and

Note 21 Deferred Taxation.

(f) Contingent liabilities

Judgements and estimates are applied to determining the probability that an outflow of resources will be required to settle an

obligation. These are made based on a review of the facts and circumstances surrounding the event and advice from both internal

and external parties. Further information is disclosed within Note 25 Contingent Liabilities.

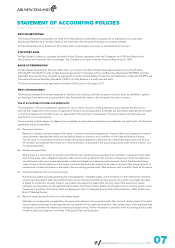

SIGNIFICANT ACCOUNTING POLICIES

The principal accounting policies applied in the preparation of these financial statements are set out below. These policies have been

consistently applied to all periods presented, unless otherwise stated.

Comparative information has been reclassified to achieve consistency in disclosure with the current period.

Subsequent to the interim six month period ended 31 December 2010 and the acquisition of an equity investment in Virgin Blue

Holdings Limited, Air New Zealand has early adopted NZ IFRS 9 (2009) - Financial Instruments for the annual financial reporting

period ending 30 June 2011. NZ IFRS 9 (2009) simplifies the mixed measurement model and establishes two primary measurement

categories for financial assets: amortised cost and fair value, which replace the categories of financial instruments defined by NZ

IAS 39, including available for sale financial assets. An irrevocable election was made on early adoption of this standard to recognise

changes in the fair value of a specified investment in quoted equity instruments through other comprehensive income. Such changes in

fair value are no longer transferred to the Statement of Financial Performance on derecognition or otherwise. No review for impairment

is required for the investment in equity instruments recognised at fair value through other comprehensive income. Further disclosures of

the impact of adopting this standard early are presented in Note 17 Financial Risk Management. In accordance with the transition relief

provided by NZ IFRS 9 (2009), prior period comparatives have not been restated.

Air New Zealand has elected to early adopt all other NZ IFRSs and Interpretations that had been issued by the New Zealand Financial

Reporting Standards Board as at 30 June 2011, except as noted below. The early adoption did not have a material impact on the

financial statements.

NZ IFRS 9 (2010) - Financial Instruments has not been adopted early. This standard adds requirements related to the classification and

measurement of financial liabilities, and derecognition of financial assets and financial liabilities to NZ IFRS 9 (2009). This Standard is

applicable for annual periods commencing on or after 1 January 2013. The impact of the application of this standard on the financial

statements has not yet been quantified.

NZ IFRS 10 - Consolidated Financial Statements has not been adopted early. NZ IFRS 10 builds on existing principles by identifying

the concept of control as the determining factor in whether an entity should be included in the consolidated financial statements of

the parent company. The amendments, which become effective for annual periods commencing on or after 1 January 2013, are not

expected to have any impact on the financial statements.

NZ IFRS 11 - Joint Arrangements has not been adopted early. NZ IFRS 11 focuses on the rights and obligations of joint arrangements

as opposed to the legal form, and requires the equity method of accounting for joint ventures. The amendments, which become effective

for annual periods commencing on or after 1 January 2013, are not expected to have any impact on the financial statements.

NZ IFRS 12 - Disclosure of Interests in Other Entities has not been early adopted. NZ IFRS 12 sets out disclosure requirements for

entities that have interests in subsidiaries, joint arrangements, associates and unconsolidated structured entities. The amendments,

which become effective for annual periods commencing on or after 1 January 2013, are not expected to have a significant impact on

the financial statements.

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 2011

STATEMENT OF ACCOUNTING POLICIES (CONTINUED)

FOR THE YEAR TO 30 JUNE 2011