Air New Zealand 2011 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2011 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

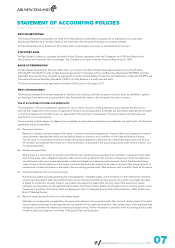

NZ IFRS 13 - Fair Value Measurement has not been adopted early. NZ IFRS 13 replaces the fair value measurement guidance

contained in individual IFRSs with a single source of guidance. It defines fair value, establishes a framework for measuring fair value and

sets out disclosure requirements. The amendments, which become effective for annual periods commencing on or after 1 January 2013,

are not expected to have a significant impact on the financial statements other than additional disclosures.

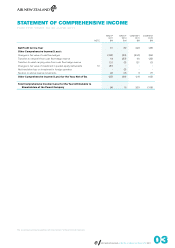

The amendments to NZ IAS 1 - Presentation of Financial Statements concerning the presentation of items of Other Comprehensive

Income have not been adopted early. The amendments require separate presentation of items that will subsequently be reclassified to

profit or loss from those that will not be reclassified. The effective date is for periods commencing on or after 1 July 2012.

The amendments to NZ IAS 19 - Employee Benefits have not been adopted early. The amendments prohibit the use of the corridor

method for recognising actuarial gains or losses, instead requiring immediate recognition as a remeasurement through other

comprehensive income. Additional disclosures will also be required. The effective date is for periods commencing on or after 1 January

2013. If these amendments had been applied as at 30 June 2011, unrecognised actuarial losses of $10 million would have been

recognised through other comprehensive income.

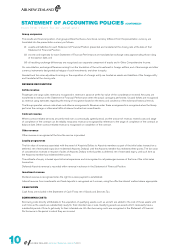

NZ IAS 27 (2011) - Separate Financial Statements has not been adopted early. NZ IAS 27 (2011) carries forward the existing

accounting and disclosure requirements for separate financial statements with some minor clarifications. The amendments, which

become effective for annual periods commencing on or after 1 January 2013, are not expected to have a significant impact on the

financial statements.

NZ IAS 28 (2011) - Investments in Associates and Joint Ventures has not been adopted early. NZ IAS 28 (2011) clarifies that an

investment in an associate or joint venture that meets the criteria to be classified as held for sale is within the scope of NZ IFRS 5

- Non-Current Assets Held for Sale and Discontinued Operations. It also requires that on cessation of siginificant influence or control,

the entity does not remeasure the retained interest. The amendments, which become effective for annual periods commencing on or

after 1 January 2013, are not expected to have a significant impact on the financial statements.

FRS 44 - New Zealand Additional Disclosures and Amendments to New Zealand Equivalents to International Financial Reporting

Standards to Harmonise with International Financial Reporting Standards and Australian Accounting Standards were issued in April

2011 and have not been adopted early. These set out New Zealand specific disclosures for entities that have adopted NZ IFRS. They

support the objective of harmonising financial reporting standards in Australia and New Zealand. The adoption of FRS 44 would result in

the simplification of some New Zealand specific disclosures, and the removal of others, although most remain unchanged. The effective

date is for reporting periods commencing on or after 1 July 2011.

BASIS OF CONSOLIDATION

The consolidated financial statements include those of the Company and its subsidiaries, accounted for using the purchase method, and

the results of its associates, accounted for using the equity method.

Subsidiaries are entities that are controlled either directly or indirectly, by the Company. Associates are those entities in which the

Group, either directly or indirectly, holds a significant but not a controlling interest.

All material intercompany transactions, balances and unrealised gains on transactions between group companies are eliminated

on consolidation. Unrealised losses are also eliminated unless the transaction provides evidence of an impairment of the asset

transferred. Unrealised gains on transactions between the Group and its associates are eliminated to the extent of the Group’s interest

in the associates.

Investments in subsidiaries are recognised in the financial statements at their cost of acquisition less any provision for impairment.

FOREIGN CURRENCY TRANSLATION

Functional currency

Items included in the financial statements of each of the Group’s entities are measured using the currency of the primary economic

environment in which the entity operates (the “functional currency”).

Transactions and balances

Foreign currency transactions are converted into the relevant functional currency using exchange rates approximating those ruling at

transaction date. Monetary assets and liabilities denominated in foreign currencies at the balance sheet date are translated at the rate

ruling at that date. Non-monetary assets and liabilities that are measured in terms of historical cost in a foreign currency are translated

using the exchange rate at the date of the transaction. Foreign exchange gains or losses are recognised in the Statement of Financial

Performance, except when deferred in equity as qualifying cash flow hedges and qualifying net investment hedges.

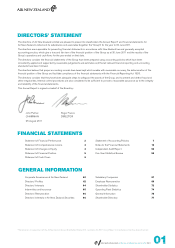

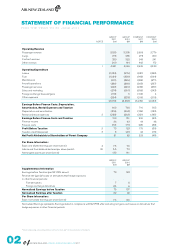

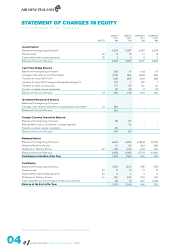

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 2011

STATEMENT OF ACCOUNTING POLICIES (CONTINUED)

FOR THE YEAR TO 30 JUNE 2011