Air New Zealand 2011 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2011 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

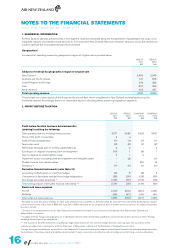

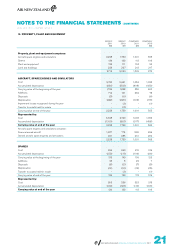

1. SEGMENTAL INFORMATION

Air New Zealand operates predominantly in one segment, its primary business being the transportation of passengers and cargo on an

integrated network of scheduled airline services to, from and within New Zealand. Resource allocation decisions across the network are

made to optimise the consolidated Group’s financial result.

Geographical

An analysis of operating revenue by geographical region of original sale is provided below.

GROUP

2011

$M

GROUP

2010

$M

Analysis of revenue by geographical region of original sale

New Zealand 2,496 2,245

Australia and Pacific Islands 611 568

United Kingdom and Europe 374 389

Asia 397 393

North America 463 451

Total operating revenue 4,341 4,046

The principal non-current assets of the Group are the aircraft fleet which is registered in New Zealand and employed across the

worldwide network. Accordingly, there is no reasonable basis for allocating these assets to geographical segments.

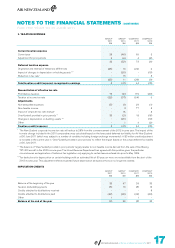

2. PROFIT BEFORE TAXATION

GROUP

2011

$M

GROUP

2010

$M

COMPANY

2011

$M

COMPANY

2010

$M

Profit before taxation has been determined after

(debiting)/crediting the following:

Total operating revenue, including finance income 4,377 4,089 3,993 3,487

Share of the profit of associates 3 6 - -

Audit of financial statements * (1) (1) (1) (1)

Termination costs (3) (5) (1) (2)

Net foreign exchange gain on working capital balances 9 3 - 4

(Loss)/gain on disposal of property, plant and equipment (10) 1 (8) 1

Gain on disposal of assets held for resale 2 1 2 -

Impairment losses on property, plant and equipment and intangible assets - (3) - (1)

Dividend income from related parties - - 256 16

Donations ** (1) (1) (1) (1)

Derivative financial instruments (refer Note 18)

Accounting ineffectiveness on cash flow hedges (3) 8 (3) 8

Components of derivatives excluded from hedge designations (28) (26) (28) (26)

Non-hedge accounted derivatives *** (105) (75) (105) (75)

Total earnings impact of derivative financial instruments **** (136) (93) (136) (93)

Rental and lease expenses

Aircraft (190) (216) (281) (304)

Buildings (48) (47) (40) (41)

Total rental and lease expenses (238) (263) (321) (345)

* Excluded from the fees above are fees for other audit related services of $195k for the year ended 30 June 2011 (30 June 2010: $196k) paid in respect

of the half-year review. Other fees of $38k (30 June 2010: $39k) were paid for tax compliance work and other assurance services (in respect of business

process controls).

** Donations include payments to the Air New Zealand Environmental Charitable Trust, Christchurch Earthquake, Kids Restore New Zealand and

Make-A-Wish Foundation.

*** Largely offset by foreign exchange gains on United States denominated interest-bearing liabilities and aircraft lease return provisions within “Foreign

exchange (losses)/gains” as noted below.

**** The transfer of the effective portion of qualifying hedge relationships from the cash flow hedge reserve to earnings upon the occurrence of the

underlying hedged item is disclosed in both the Statement of Movements in Equity and the Statement of Comprehensive Income.

“Foreign exchange (losses)/gains” as disclosed in the Statement of Financial Performance comprise realised gains/(losses) from operating hedge derivatives,

the translation of monetary assets and liabilities denominated in foreign currencies and ineffective and non-hedge accounted foreign currency derivatives.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR TO 30 JUNE 2011

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 2011