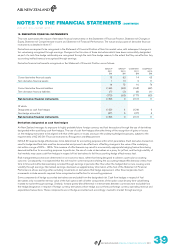

Air New Zealand 2011 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2011 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

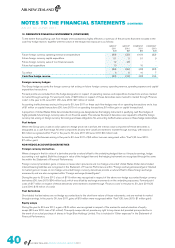

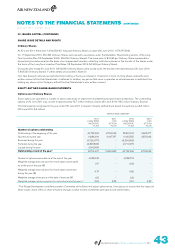

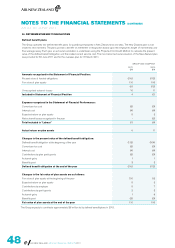

22. ISSUED CAPITAL (CONTINUED)

Long Term Incentive Plan (LTIP)

On 17 September 2010, 11,884,690 options with a fair value of $2.8 million were issued to executives under the LTIP (18 September

2009: 11,923,525 options with a fair value of $3.0 million). Total options outstanding under the LTIP are 42,791,447 (30 June 2010:

40,722,469). The unamortised fair value of outstanding LTIP options (measured at grant date) is $3.3 million (30 June 2010: $3.6 million).

The options may be exercised at any time between three and five years after the date of issue (subject to compliance with insider

trading restrictions and the rules of the scheme), but may lapse if the participants leave the Group in certain specified circumstances.

The exercise price will be set three years after issue, and will be based on the Company share price at the issue date increased or

decreased by the percentage movement in a specified index over the three years, and decreased by any distributions made by the

Company over the same period. The specified index comprises the total shareholder return for the NZSX All Gross Index and the Dow

Jones World Airline Total Return Index in 50:50 proportions.

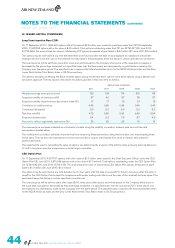

The general principles underlying the Black Scholes option pricing model have been used to value these options using a Monte Carlo

simulation approach. The key inputs to this model for options granted in that year were as follows:

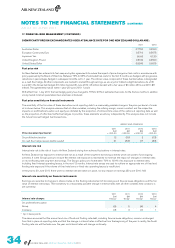

GROUP AND COMPANY

2011 2010 2009 2008 2007

Weighted average share price (cents) 129 124 114 216 116

Expected volatility of share price (%) 37 40 37 35 37

Expected volatility of performance benchmark index (%) 17 17 15 13 13

Correlation of volatility indices 0.45 0.50 0.45 0.45 0.40

Contractual life (years) 5.0 5.0 5.0 5.0 5.0

Risk free rate (%) 4.72 5.50 5.90 6.42 5.94

Expected dividend yield 5.4 5.2 7.5 3.7 4.3

Discount to reflect negotiability restrictions (%) 25 25 25 15 15

The exercise price has been modelled as a stochastic variable, using the volatility, correlation, dividend yield and risk free rate

assumptions detailed above.

The volatility and correlation estimates were derived from measuring these parameters using historical data over the preceding three

to five years. The risk free rate was based on the five year zero bond coupon yield implied from short to medium term yields for

government bonds.

The expected life used in calculating the value of options was determined by analysis of the attrition rates and early exercise behaviour

of staff in long term incentive programmes in similar large corporates.

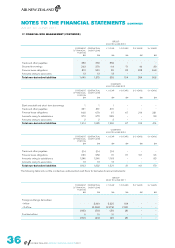

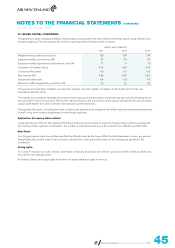

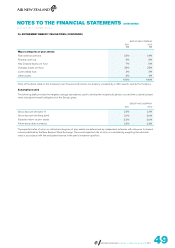

CEO Option Plan

On 17 September 2010, 4,067,797 options with a fair value of $1.0 million were issued to the Chief Executive Officer under the CEO

Option Plan (30 June 2010: 3,870,968 options with a fair value of $1.0 million). Total options outstanding under the CEO Option Plan

are 12,861,842 (30 June 2010: 8,794,045). The unamortised fair value of outstanding CEO Option Plan options (measured at grant

date) is $1.3 million (30 June 2010: $1.2 million).

The options may be exercised at any time between two to four years after the date of issue (2010: three to five years after the date of

issue) for the CEO Option Plan (subject to compliance with insider trading restrictions and the rules of the scheme), but may lapse if the

participant leaves the Group in certain specified circumstances.

The exercise price will be set two years after issue (2010: three years after issue), and will be based on the Company share price at

the issue date increased or decreased by the percentage movement in a specified index over the two years (2010: three years), and

decreased by any distributions made by the Company over the same period. The specified index comprises the total shareholder return

for the NZSX All Gross Index and the Dow Jones World Airline Total Return Index in 50:50 proportions.

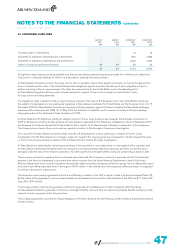

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

AS AT 30 JUNE 2011

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 2011