Air New Zealand 2011 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2011 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

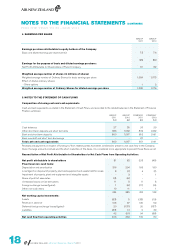

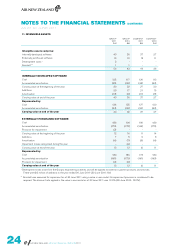

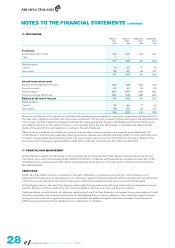

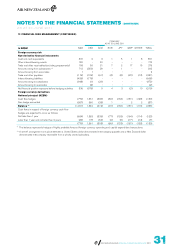

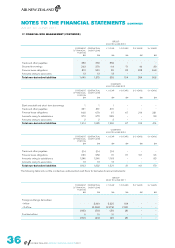

16. PROVISIONS

GROUP

2011

$M

GROUP

2010

$M

COMPANY

2011

$M

COMPANY

2010

$M

Provisions

Aircraft lease return costs 166 202 165 202

Other 1---

167 202 165 202

Represented by:

Current 79 65 77 65

Non-current 88 137 88 137

167 202 165 202

Aircraft lease return costs

Balance at the beginning of the year 202 198 202 196

Amount provided 60 64 59 63

Amount utilised (64) (47) (64) (45)

Foreign exchange differences (32) (13) (32) (12)

Balance at the end of the year 166 202 165 202

Represented by:

Current 78 65 77 65

Non-current 88 137 88 137

166 202 165 202

Where a commitment exists to maintain aircraft held under operating lease arrangements, a provision is made during the lease term for

the lease return obligations specified within those lease agreements. The provision is based on the present value of the estimated future

costs of major airframe inspections and engine overhauls by making appropriate charges to the Statement of Financial Performance,

calculated by reference to the number of hours or cycles operated during the year. The provision is expected to be utilised over the

shorter of the period to the next inspection or overhaul or the end of the lease.

Other provisions include amounts relating to insurance and warranties. Insurance provisions are expected to be utilised within 12

months based on historical claim experience. Warranty provisions represent an estimate of potential liability for future rectification work

in respect of past engineering services performed. The usual warranty period is less than 12 months from the date of delivery of the

serviced aircraft. The Group recognised additions of $1 million in the year ended 30 June 2011 (30 June 2010: Nil).

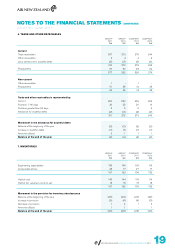

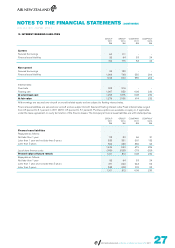

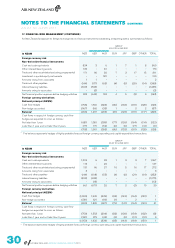

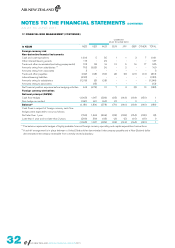

17. FINANCIAL RISK MANAGEMENT

Air New Zealand is subject to credit, foreign currency, interest rate, and fuel price risks. These risks are managed with various financial

instruments, using a set of policies approved by the Board of Directors. Compliance with these policies is reviewed and reported monthly

to the Board and is included as part of the internal audit programme. Group policy is not to enter, issue or hold financial instruments for

speculative purposes.

CREDIT RISK

Credit risk is the potential loss from a transaction in the event of default by a counterparty during the term of the transaction or on

settlement of the transaction. Air New Zealand incurs credit risk in respect of trade receivable transactions and other financial instruments

in the normal course of business. The maximum exposure to credit risk is represented by the carrying value of financial assets.

Air New Zealand places cash, short term deposits and derivative financial instruments with good credit quality counterparties, having a

minimum Standard and Poors credit rating of A. Limits are placed on the exposure to any one financial institution.

Credit evaluations are performed on all customers requiring direct credit. Air New Zealand is not exposed to any concentrations of credit

risk within receivables, other assets and derivatives. Air New Zealand does not require collateral or other security to support financial

instruments with credit risk. A significant proportion of receivables are settled through the International Aviation Travel Association

(IATA) clearing mechanism which undertakes its own credit review of members.

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

AS AT 30 JUNE 2011

AIR NEW ZEALAND ANNUAL FINANCIAL RESULTS 2011