Air New Zealand 2008 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2008 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND

STATEMENT OF ACCOUNTING POLICIES (CONTINUED)

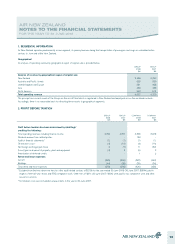

BASIS OF CONSOLIDATION

The consolidated financial statements include those of the Company and its subsidiaries, accounted for using the purchase method, and the results of its

associates, accounted for using the equity method.

Subsidiaries are entities that are controlled either directly or indirectly, by the Company. Associates are those entities in which the Group, either directly

or indirectly, holds a significant but not a controlling interest.

All material intercompany transactions, balances and unrealised gains on transactions between group companies are eliminated on consolidation.

Unrealised losses are also eliminated unless the transaction provides evidence of an impairment of the asset transferred. Unrealised gains on

transactions between the Group and its associates are eliminated to the extent of the Group’s interest in the associates.

Investments in subsidiaries and associates are recognised in the financial statements at their cost of acquisition less any provision for impairment.

FOREIGN CURRENCY TRANSLATION

Functional currency

Items included in the financial statements of each of the Group’s entities are measured using the currency of the primary economic environment in which

the entity operates (the “functional currency”).

Transactions and balances

Foreign currency transactions are converted into the relevant functional currency using exchange rates approximating those ruling at transaction date.

Monetary assets and liabilities denominated in foreign currencies at the balance sheet date are translated at the rate ruling at that date. Non-monetary

assets and liabilities that are measured in terms of historical cost in a foreign currency are translated using the exchange rate at the date of the

transaction. Foreign exchange gains or losses are recognised in the income statement, except when deferred in equity as qualifying cash flow hedges

and qualifying net investment hedges.

Group companies

The results and financial position of all group entities that have a functional currency different from the presentation currency are translated into the

presentation currency as follows:

(i) assets and liabilities for each Statement of Financial Position presented are translated at the closing rate at the date of that Statement of

Financial Position;

(ii) income and expenses for each Statement of Financial Performance are translated at exchange rates approximating those ruling at transaction

date; and

(iii) all resulting exchange differences are recognised as a separate component of equity.

On consolidation, exchange differences arising from the translation of the net investment in foreign entities, and of borrowings and other currency

instruments designated as hedges of such investments, are taken to equity.

As at 1 July 2006 (transition date), cumulative translation differences for all foreign operations, previously recognised within the foreign currency

translation reserve (a component of equity) have been transferred to retained earnings within equity in accordance with the exemption available under

NZ IFRS 1: First-time adoption of NZ IFRS.

Goodwill and fair value adjustments arising on the acquisition of a foreign entity are treated as assets and liabilities of the foreign entity and translated at

the closing rate.

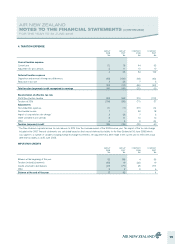

REVENUE RECOGNITION

Airline revenue

Passenger and cargo sales revenue is recognised in revenue in advance at the fair value of the consideration received. Amounts are transferred to

revenue in the Statement of Financial Performance when the actual carriage is performed. Unused tickets are recognised as revenue using estimates

regarding the timing of recognition based on the terms and conditions of the ticket and historical trends.

The Group operates various codeshare and alliance arrangements. Revenue under these arrangements is recognised when Group performs the carriage

or otherwise fulfils all relevant contractual commitments.

Contract revenue

Where contract related services are performed over a contractually agreed period, and the amount of revenue, related costs and stage of completion

of the contract can be reliably measured, revenue is recognised by reference to the stage of completion of the contract at balance date. Other contract

related revenue is recognised on completion of the contract.

7