Air New Zealand 2008 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2008 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

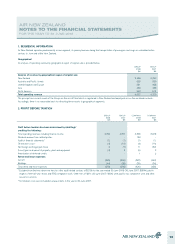

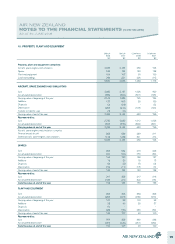

PROPERTY, PLANT AND EQUIPMENT

Owned assets

Items of property, plant and equipment are stated at cost or deemed cost less accumulated depreciation and accumulated impairment losses. Cost

includes expenditure that is directly attributable to the acquisition of the item and in bringing the asset to the location and working condition for its

intended use. Cost may also include transfers from equity of any gains or losses on qualifying cash flow hedges of foreign currency purchases of

property, plant and equipment.

Certain items of property, plant and equipment, which had been revalued to fair value on or prior to 1 July 2006 (transition date) are measured on the

basis of deemed cost, being the revalued amount at the date of that independent revaluation.

Where significant parts of an item of property, plant and equipment have different useful lives, they are accounted for separately.

A portion of the cost of an acquired aircraft is attributed to its service potential (reflecting the maintenance condition of its engines and airframe) and is

depreciated over the shorter of the period to the next major inspection event, overhaul, or the remaining life of the asset.

Leased assets

Leases under which the Group assumes substantially all the risks and rewards of ownership are classified as finance leases. All other leases are

classified as operating leases.

Upon initial recognition, assets held under finance leases are measured at amounts equal to the lower of their fair value and the present value of the

minimum lease payments at inception of the lease. A corresponding liability is also established.

Subsequent to initial recognition, the asset is accounted for in accordance with the accounting policy applicable to that asset.

Manufacturers’ credits

The Group receives credits from manufacturers in connection with the acquisition of certain aircraft and engines. These credits are recorded as a

reduction to the cost of the related aircraft and engines. When the aircraft are held under operating leases, the credits are deferred and reduced from

the operating lease rentals on a straight-line basis over the period of the related lease as deferred credits.

DEPRECIATION

Aircraft

Depreciation of the aircraft fleet is calculated to write down the cost of these assets on a straight line basis to an estimated residual value over their

economic lives. The aircraft and related engines, simulators and spares are being depreciated on a straight line basis as follows:

Airframe 10 - 22 years

Engines 5 – 22 years

Airframe inspections period to next similar inspection

Engine overhauls period to next overhaul

The residual values of aircraft are reviewed annually by reference to Avitas projected values.

Non-aircraft

Non-aircraft assets are depreciated on a straight line basis using the following estimated economic lives:

Buildings 50 – 100 years

Aircraft specific plant and equipment 10 – 20 years

Non-aircraft specific leasehold improvements, plant, equipment, furniture and vehicles 3 - 10 years

Gains and losses on disposal are determined by comparing proceeds with carrying amounts. These are included in the Statement of Financial

Performance.

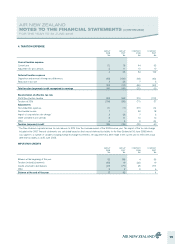

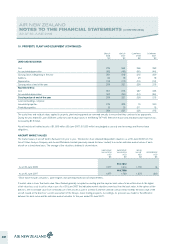

INTANGIBLE ASSETS

Goodwill

Goodwill represents the cost of an acquisition over and above the fair value of the Group’s share of the net identifiable assets acquired. Goodwill arising

on acquisition of a subsidiary is included in intangible assets. Goodwill arising on acquisition of an associate is included in the carrying value of the

investment in that associate. Goodwill is tested annually for impairment and carried at cost less accumulated impairment losses. Gains and losses on the

disposal of an entity include the carrying amount of goodwill relating to the entity sold.

AIR NEW ZEALAND

STATEMENT OF ACCOUNTING POLICIES (CONTINUED)

10