Air New Zealand 2008 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2008 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

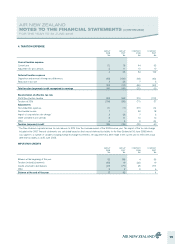

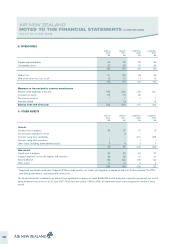

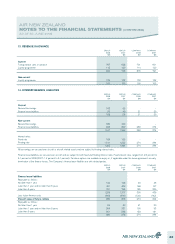

4. TAXATION EXPENSE

GROUP

2008

$M

GROUP

2007

$M

COMPANY

2008

$M

COMPANY

2007

$M

Current taxation expense

Current year (1) 15 44 92

Adjustment for prior periods 5 11 10 10

4 26 54 102

Deferred taxation expense

Origination and reversal of temporary differences (93) (100) (93) (48)

Reduction in tax rate 3 26 7 6

(90) (74) (86) (42)

Total taxation (expense)/credit recognised in earnings (86) (48) (32) 60

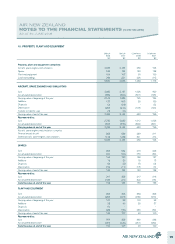

Reconciliation of effective tax rate

Profit/(loss) before taxation 304 269 216 (113)

Taxation at 33% (100) (89) (71) 37

Adjustments

Non-deductible expenses (1) (1) (31) (6)

Non-taxable income 1 - 50 18

Impact of corporate tax rate change* 3 26 7 6

Under provided in prior periods 5 11 10 10

Other 6 5 3 (5)

Taxation (expense)/credit (86) (48) (32) 60

* The New Zealand corporate income tax rate reduces to 30% from the commencement of the 2009 income year. The impact of the tax rate change

included in the 2007 financial statements was calculated based on the forecast deferred tax liability for Air New Zealand at 30 June 2008 (which

was subject to a number of variables including foreign exchange movements). An adjustment has been made in the current year to reflect the actual

deferred tax liability as at 30 June 2008.

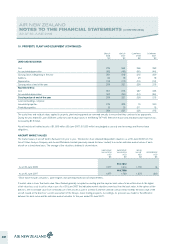

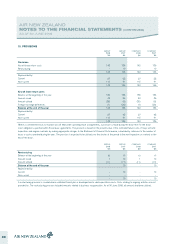

IMPUTATION CREDITS

GROUP

2008

$M

GROUP

2007

$M

COMPANY

2008

$M

COMPANY

2007

$M

Balance at the beginning of the year 92 148 4 56

Taxation (refunds)/payments (33) 19 (32) 19

Credits attached to distributions (49) (77) 25 (77)

Other 3 2 3 6

Balance at the end of the year 13 92 - 4

AIR NEW ZEALAND

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

FOR THE YEAR TO 30 JUNE 2008

15