Air New Zealand 2008 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2008 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

AS AT 30 JUNE 2008

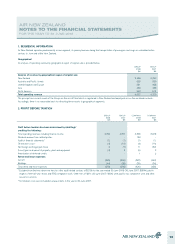

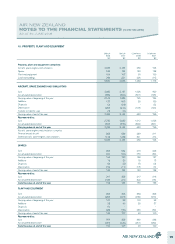

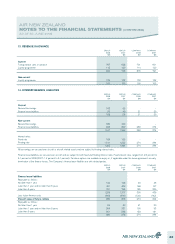

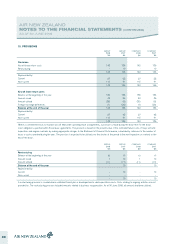

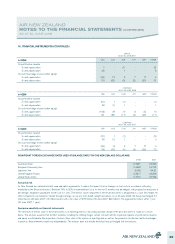

13. REVENUE IN ADVANCE

GROUP

2008

$M

GROUP

2007

$M

COMPANY

2008

$M

COMPANY

2007

$M

Current

Transportation sales in advance 707 628 701 601

Loyalty programme 115 120 114 120

822 748 815 721

Non-current

Loyalty programme 109 102 109 102

109 102 109 102

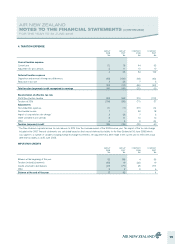

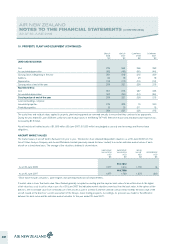

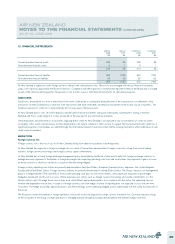

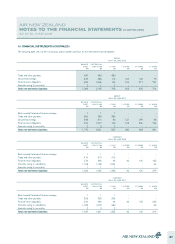

14. INTEREST-BEARING LIABILITIES

GROUP

2008

$M

GROUP

2007

$M

COMPANY

2008

$M

COMPANY

2007

$M

Current

Secured borrowings 103 66 - -

Finance lease liabilities 55 49 21 20

158 115 21 20

Non-current

Secured borrowings 342 440 - -

Finance lease liabilities 825 829 253 274

1,167 1,269 253 274

Interest rates:

Fixed rate 184 162 - -

Floating rate 1,141 1,222 274 294

1,325 1,384 274 294

All borrowings are secured over aircraft or aircraft related assets and are subject to floating interest rates.

Finance lease liabilities are secured over aircraft and are subject to both fixed and floating interest rates. Fixed interest rates ranged from 2.5 percent to

5.1 percent in 2008 (2007: 1.2 percent to 5.1 percent). Purchase options are available on expiry or, if applicable under the lease agreement, on early

termination of the finance leases. The Company’s finance lease liabilities are with related parties.

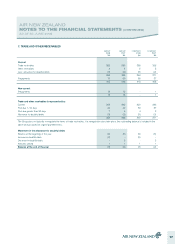

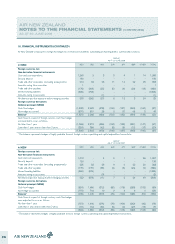

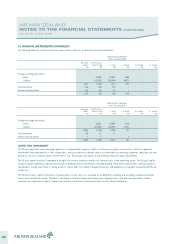

GROUP

2008

$M

GROUP

2007

$M

COMPANY

2008

$M

COMPANY

2007

$M

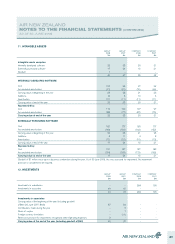

Finance lease liabilities

Repayable as follows:

Not later than 1 year 106 103 43 43

Later than 1 year and not later than 5 years 421 409 168 167

Later than 5 years 701 765 185 226

1,228 1,277 396 436

Less future finance costs (348) (399) (122) (142)

Present value of future rentals 880 878 274 294

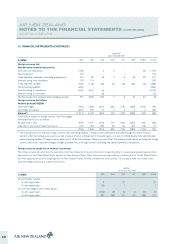

Repayable as follows:

Not later than 1 year 55 49 21 20

Later than 1 year and not later than 5 years 264 231 100 93

Later than 5 years 561 598 153 181

880 878 274 294

23