Air New Zealand 2008 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2008 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

AS AT 30 JUNE 2008

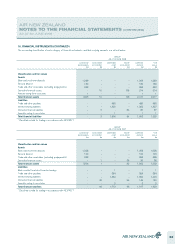

22. CAPITAL COMMITMENTS (CONTINUED)

On 22 September 2004, the Board of directors approved a plan to purchase seventeen Bombardier Q300 (Q300) aircraft and associated engines to

replace the Group’s SAAB 340 fleet. Approval was subsequently granted to convert an additional six purchase rights into firm orders, bringing the total

order to 23 aircraft. As at 30 June 2008, the Group had taken delivery of twenty-one aircraft. The remaining two aircraft are expected to be delivered

during the period April 2009 to May 2009. As at the date of publishing these financial statements the Group also has the right (but no obligation) to

purchase an additional fifteen Q400 aircraft.

On 3 August 2007, the Company confirmed the purchase of four B777-300ER (B773ER) aircraft, and associated engines, by converting existing

purchase rights into firm commitments. The Company has also converted an additional three purchase rights into options. The B773ER aircraft subject

to firm commitments will be introduced over the period from November 2010 to November 2011.

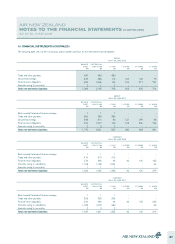

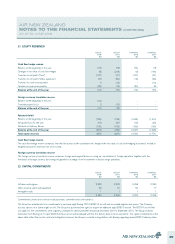

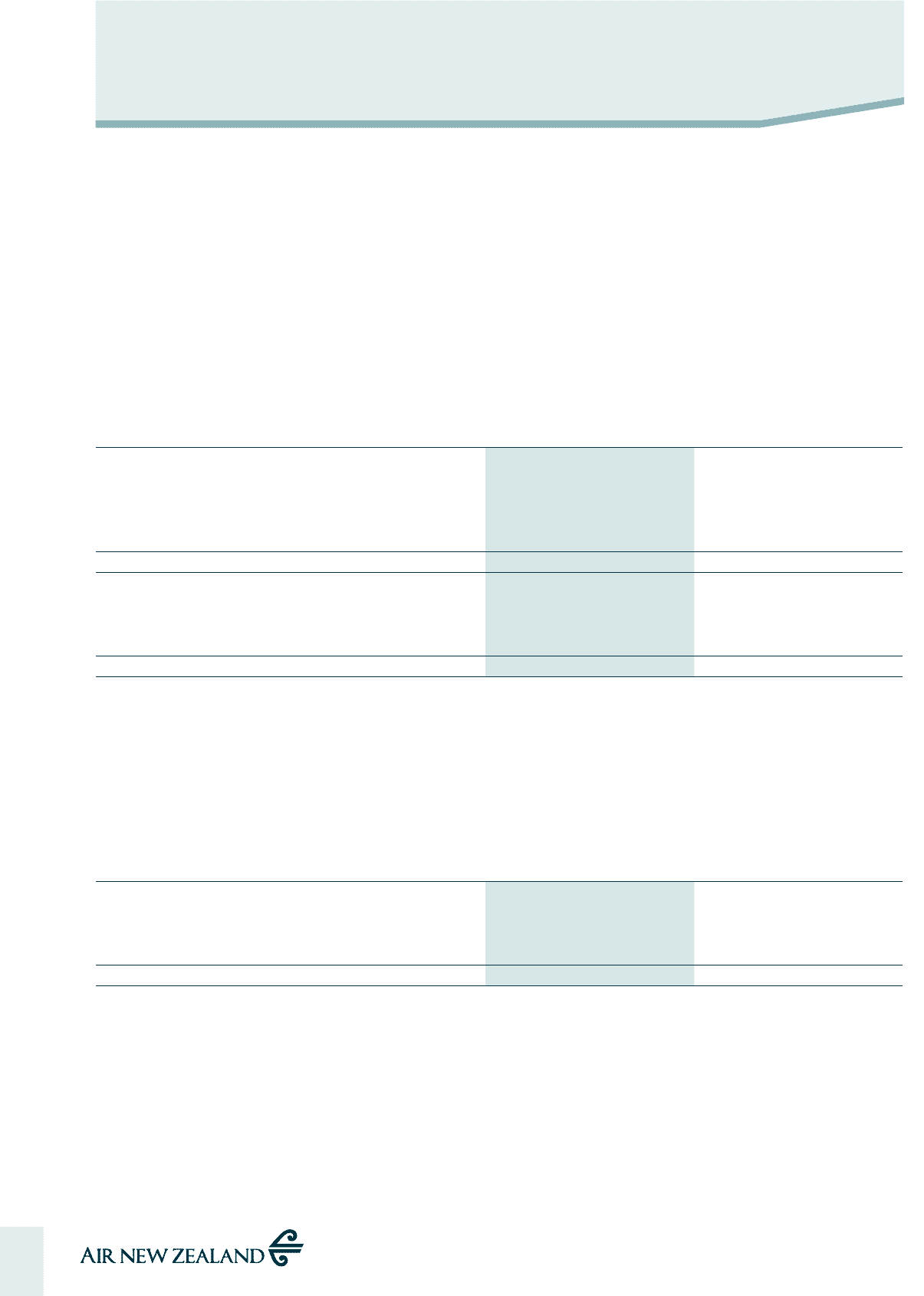

23. OPERATING LEASE COMMITMENTS

GROUP

2008

$M

GROUP

2007

$M

COMPANY

2008

$M

COMPANY

2007

$M

Aircraft leases payable

Not later than 1 year 227 226 88 110

Later than 1 year and not later than 5 years 349 516 187 234

Later than 5 years 14 13 212 255

590 755 487 599

Property leases payable

Not later than 1 year 26 25 23 23

Later than 1 year and not later than 5 years 75 69 69 62

Later than 5 years 94 71 92 68

195 165 184 153

The Company leases a number of aircraft from its wholly owned subsidiary, Air New Zealand Aircraft Holdings Limited.

New Zealand International Airlines Limited, a wholly owned subsidiary, has the option to purchase two Boeing 737-300 aircraft which are currently under

an operating lease arrangement. The options may be exercised at certain predetermined dates, lapsing in September 2011 and July 2012. The directors

expect that the options will not be exercised.

Subject to negotiation, certain aircraft operating leases give the Group the right to renew the lease.

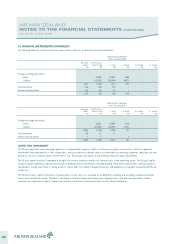

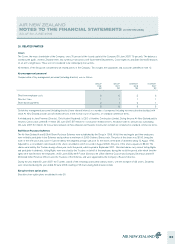

24. CONTINGENT LIABILITIES

GROUP

2008

$M

GROUP

2007

$M

COMPANY

2008

$M

COMPANY

2007

$M

Uncalled capital of subsidiaries - - 2 2

Guarantee of subsidiary indebtedness - - 1,325 1,384

Letters of credit and performance bonds 21 18 14 12

21 18 1,341 1,398

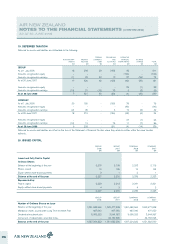

All significant legal disputes involving probable loss that can be reliably estimated have been provided for in the financial statements. There are no

contingent liabilities for which it is practicable to estimate the financial effect.

Air New Zealand has been named in four class actions. One, in Australia, claims travel agents commission on fuel surcharges and two (one in Australia

and the other in the United States) make allegations against more than 30 airlines, of anti competitive conduct in relation to pricing in the air cargo

business. The allegations made in relation to the air cargo business are also the subject of investigations by regulators in a number of jurisdictions

including the United States and the European Union. A formal Statement of Objections has been issued by the European Commission to 25 airlines

including Air New Zealand and has been responded to. In the event that a court determined, or it was agreed with a regulator, that Air New Zealand

had breached relevant laws, the Company would have potential liability for pecuniary penalties and to third party damages under the laws of the relevant

jurisdictions. The fourth class action alleges (in the United States) that Air New Zealand together with 11 other airlines conspired in respect of fares and

surcharges on trans-Pacific routes. All class actions are being defended. No other significant contingent liability claims are outstanding at balance date.

40