Air New Zealand 2008 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2008 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

AS AT 30 JUNE 2008

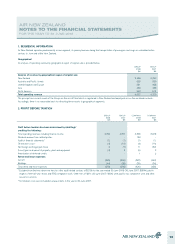

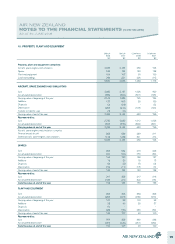

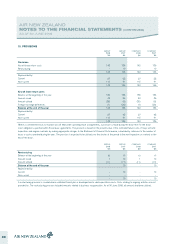

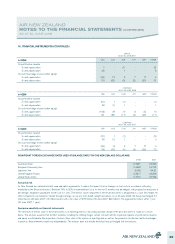

11. INTANGIBLE ASSETS

GROUP

2008

$M

GROUP

2007

$M

COMPANY

2008

$M

COMPANY

2007

$M

Intangible assets comprise:

Internally developed software 22 23 20 21

Externally purchased software 17 24 15 21

Goodwill 1 - - -

40 47 35 42

INTERNALLY DEVELOPED SOFTWARE

Cost 100 95 97 92

Accumulated amortisation (77) (67) (76) (66)

Carrying value at beginning of the year 23 28 21 26

Additions 10 6 10 6

Amortisation (11) (11) (11) (11)

Carrying value at end of the year 22 23 20 21

Represented by:

Cost 110 100 107 97

Accumulated amortisation (88) (77) (87) (76)

Carrying value at end of the year 22 23 20 21

EXTERNALLY PURCHASED SOFTWARE

Cost 187 177 183 177

Accumulated amortisation (163) (152) (162) (152)

Carrying value at beginning of the year 24 25 21 25

Additions 4 11 4 8

Amortisation (11) (12) (10) (12)

Carrying value at end of the year 17 24 15 21

Represented by:

Cost 191 187 187 183

Accumulated amortisation (174) (163) (172) (162)

Carrying value at end of the year 17 24 15 21

Goodwill of $1 million arose upon a business combination during the year. As at 30 June 2008, this was assessed for impairment. No impairment

provision is considered to be required.

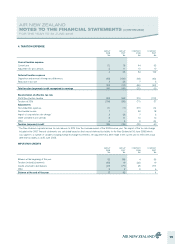

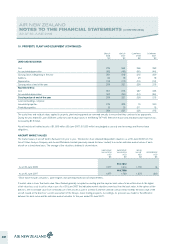

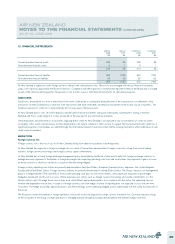

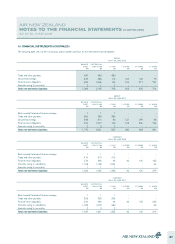

12. INVESTMENTS

GROUP

2008

$M

GROUP

2007

$M

COMPANY

2008

$M

COMPANY

2007

$M

Investments in subsidiaries - - 284 190

Investments in associates 49 47 - -

49 47 284 190

Investments in associates

Carrying value at the beginning of the year (including goodwill

of $Nil (30 June 2007: $Nil)) 47 54 - -

Contributions made during the year - 3 - -

Share of surplus - 1 - -

Foreign currency translation - (11) - -

Reversal in provision for impairment, recognised within Operating expenses 2 - - -

Carrying value at the end of the year (including goodwill of $Nil) 49 47 - -

21