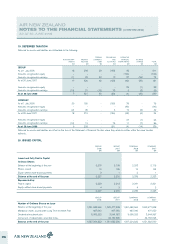

Air New Zealand 2008 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2008 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

AS AT 30 JUNE 2008

16. FINANCIAL INSTRUMENTS (CONTINUED)

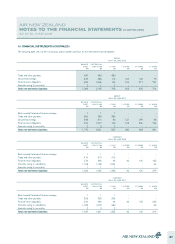

GROUP AND COMPANY

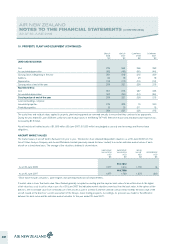

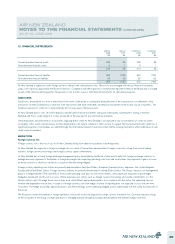

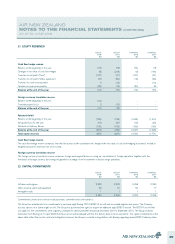

Price movement per barrel:

2008

$M

+ USD 25

2008

$M

- USD 25

2007

$M

+ USD 25

2007

$M

- USD 25

On profit before taxation 85 (89) 62 (62)

On cash flow hedge reserve (within equity) 15 (6) 58 (43)

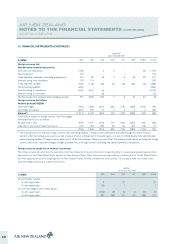

Interest rate risk

Interest rate risk is the risk of loss to Air New Zealand arising from adverse fluctuations in interest rates.

Air New Zealand has exposure to interest rate risk as a result of the long-term borrowing activities which are used to fund ongoing activities. It is the

Group’s policy to ensure the interest rate exposure is maintained to minimise the impact of changes in interest rates on its floating rate long-term

borrowings. The Group’s policy is to fix between 70% to 100% of its exposure to interest rates, including fixed interest operating leases, in the next 12

months. Interest rate swaps have been entered into to achieve an appropriate mix of fixed and floating rate exposure.

Interest rate derivatives are not hedge accounted. Changes in the fair value of these derivatives are recognised each period within Finance costs. As at

30 June 2008, the notional principal or contract amounts of interest rate derivatives outstanding is USD 120 million (30 June 2007: USD 345 million)

with a fair value liability of $2 million (30 June 2007: $1 million asset). The contracts mature within 8 months (30 June 2007: 20 months).

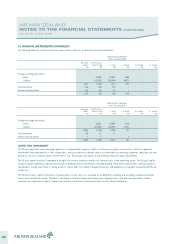

Interest rate sensitivity on financial instruments

Earnings are sensitive to changes in interest rates on the floating rate element of borrowings and finance lease obligations and the fair value of interest

rate swaps. Their sensitivity to a reasonably possible change in interest rates with all other variables held constant, is set out below:

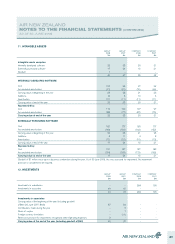

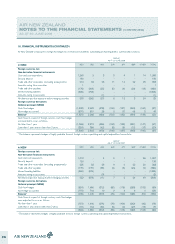

Interest rate change:

2008

$M

+50 bp*

2008

$M

-50 bp*

2007

$M

+50 bp*

2007

$M

-50 bp*

On profit before taxation

Group (6) 6 (5) 5

Company (1) 1 - -

* bp = basis points

The above assumes that the amount and mix of fixed and floating rate debt, including finance lease obligations, remains unchanged from that in place at

reporting date, and that the change in interest rates is effective from the beginning of the year. In reality, the fixed/floating rate mix will fluctuate over the

year and interest rates will change continually.

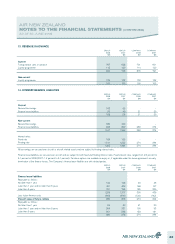

Sensitivity analyses

The sensitivity analyses shown above are hypothetical and should not be considered predictive of future performance. It only includes financial

instruments (derivative and non-derivative) and does not include the future forecast hedged transactions. As the sensitivities are only on financial

instruments the sensitivities ignore the offsetting impact on future forecast transactions which many of the derivatives are hedging. Changes in fair

value can generally not be extrapolated because the relationship of change in assumption to change in fair value may not be linear. In addition, for the

purposes of the above analyses, the effect of a variation in a particular assumption is calculated independently of any change in another assumption.

In reality, changes in one factor may contribute to changes in another, which may magnify or counteract the sensitivities. Furthermore, sensitivities to

specific events or circumstances will be counteracted as far as possible through strategic management actions. The estimated fair values as disclosed

should not be considered indicative of future earnings on these contracts.

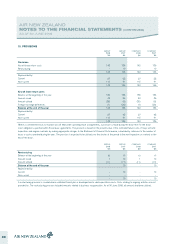

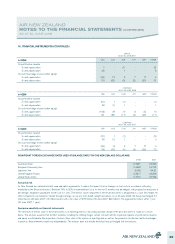

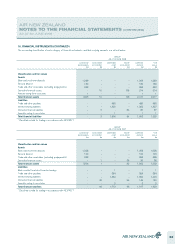

LIQUIDITY RISK

Air New Zealand holds significant cash reserves to enable it to meet its liabilities as they fall due and to protect operations from unanticipated external

factors or events.

30