Air New Zealand 2008 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2008 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

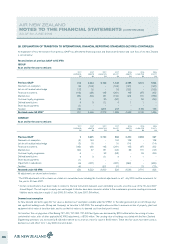

28. EXPLANATION OF TRANSITION TO INTERNATIONAL FINANCIAL REPORTING STANDARDS (NZ IFRS) (CONTINUED)

Impairment in subsidiaries

The application of adjustments on transition to NZ IFRS in certain subsidiaries within the Air New Zealand Group triggered a review for impairment of

the carrying value of intercompany advances and investments in respect of those subsidiaries, resulting in a decrease in the Company’s other assets and

equity on transition to NZ IFRS.

Taxation

NZ IFRS requires deferred taxation to be determined using a balance sheet method as opposed to the income statement method employed under

previous GAAP. Under the balance sheet approach, income tax on the profit or loss for the year comprises both current and deferred taxation. In brief,

temporary differences are differences between the carrying value of assets and liabilities for financial reporting purposes as compared to their carrying

value for tax purposes. Temporary differences may give rise to deferred tax assets or deferred tax liabilities.

The movement in equity in respect of taxation includes the tax on movements in the cash flow hedge reserve for the year and the reversal of tax within

the foreign currency translation reserve under previous GAAP.

Intangible assets

Under previous GAAP, the Group did not recognise any intangible assets. NZ IAS 38: Intangible Assets and related interpretations require computer

software that is not an integral part of the related computer hardware to be treated as an intangible asset, provided certain criteria are met. Such assets

have been reclassified from Property, Plant and Equipment to Intangible Assets.

Statement of Cash Flows

Engine and airframe maintenance which was expensed under previous GAAP, and capitalised under NZ IFRS, has been reclassified from “Payments to

suppliers and employees” to “Acquisition of property, plant and equipment and intangibles”. For the year to 30 June 2007, this amounted to $42 million

in the Group and $31 million in the Company.

The detailed documentation requirements introduced on conversion to NZ IFRS has facilitated further segregation of the line “Rollover of foreign

exchange contracts” between operating, investing and financing activities. Prior year comparatives have been restated accordingly.

AIR NEW ZEALAND

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

AS AT 30 JUNE 2008

48