Air New Zealand 2008 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2008 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

AS AT 30 JUNE 2008

16. FINANCIAL INSTRUMENTS (CONTINUED)

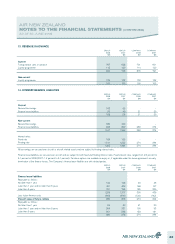

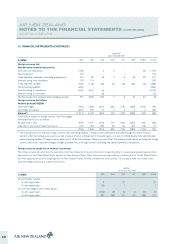

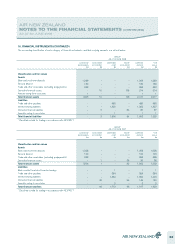

The accounting classification of each category of financial instruments, and their carrying amounts, are set out below:

GROUP

AS AT 30 JUNE 2008

LOANS AND

RECEIVABLES

$M

NON-HEDGE

ACCOUNTED*

$M

AMORTISED

COST

$M

HEDGE

ACCOUNTED

$M

CARRYING

AMOUNT

$M

FAIR

VALUE

$M

Classification and fair values

Assets

Bank and short term deposits 1,289 - - - 1,289 1,289

Security deposit 130 - - - 130 130

Trade and other receivables (excluding prepayments) 383 - - - 383 383

Derivative financial assets - 16 - 198 214 214

Amount owing from associates 1 - - - 1 1

Total financial assets 1,803 16 - 198 2,017 2,017

Liabilities

Trade and other payables - - 480 - 480 480

Interest-bearing liabilities - - 1,325 - 1,325 1,357

Derivative financial liabilities - 3 - 84 87 87

Amounts owing to associates - - 1 - 1 1

Total financial liabilities - 3 1,806 84 1,893 1,925

* Classified as held for trading in accordance with NZ IFRS 7.

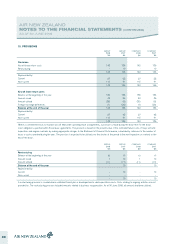

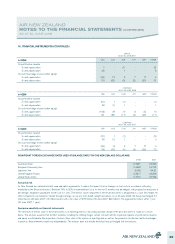

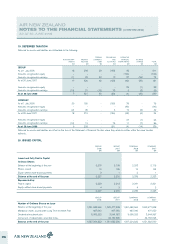

GROUP

AS AT 30 JUNE 2007

LOANS AND

RECEIVABLES

$M

NON-HEDGE

ACCOUNTED*

$M

AMORTISED

COST

$M

HEDGE

ACCOUNTED

$M

CARRYING

AMOUNT

$M

FAIR

VALUE

$M

Classification and fair values

Assets

Bank and short term deposits 1,058 - - - 1,058 1,058

Security deposit 120 - - - 120 120

Trade and other receivables (excluding prepayments) 388 - - - 388 388

Derivative financial assets - 1 - 35 36 36

Total financial assets 1,566 1 - 35 1,602 1,602

Liabilities

Bank overdraft and short-term borrowings - - 1 - 1 1

Trade and other payables - - 384 - 384 384

Interest-bearing liabilities - - 1,384 - 1,384 1,420

Derivative financial liabilities - 49 - 96 145 145

Amounts owing to associates - - 3 - 3 3

Total financial liabilities - 49 1,772 96 1,917 1,953

* Classified as held for trading in accordance with NZ IFRS 7.

33