Air New Zealand 2008 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2008 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND

STATEMENT OF ACCOUNTING POLICIES (CONTINUED)

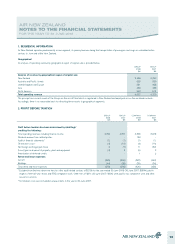

Trade and other receivables

Trade and other receivables are recognised at cost less any provision for impairment. A provision for impairment is established when collection is

considered to be doubtful. When a trade receivable is considered uncollectible, it is written-off against the provision.

Financial liabilities at amortised cost:

Borrowings

Borrowings are initially recognised at fair value, net of transaction costs incurred. Borrowings are subsequently stated at amortised cost using the

effective interest rate method, where appropriate. Borrowings are classified as current liabilities unless the Group has an unconditional right to defer

settlement of the liability for more than 12 months after the balance sheet date.

Finance leases

Finance lease obligations are initially stated at fair value, net of transaction costs incurred. The obligations are subsequently stated at amortised cost.

Trade and other payables

Trade and other payables are stated at cost.

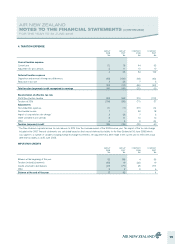

DERIVATIVE FINANCIAL INSTRUMENTS

Air New Zealand uses derivative financial instruments to manage its exposure to foreign exchange, fuel price and interest rate risks arising from

operational, financing and investment activities. Derivative financial instruments are recognised initially at fair value and transaction costs are expensed

immediately. Subsequent to initial recognition, derivative financial instruments are recognised as described below:

Derivative financial instruments at fair value through profit or loss

Derivative financial instruments, other than those designated as hedging instruments in a qualifying cash flow hedge (refer below), are classified as held

for trading. Subsequent to initial recognition, derivative financial instruments in this category are stated at fair value. The gain or loss on remeasurement

to fair value is recognised immediately in the Statement of Financial Performance.

Hedge accounted derivative financial instruments

Where derivatives qualify for hedge accounting in accordance with NZ IAS 39: Financial Instruments: Recognition and Measurement, recognition of any

resultant gain or loss depends on the nature of the hedging relationship, as detailed below.

Cash flow hedges

Changes in the fair value of derivative hedging instruments designated as cash flow hedges are recognised directly in the cash flow hedge reserve within

equity to the extent that the hedges are deemed effective in accordance with NZ IAS 39: Financial Instruments: Recognition and Measurement. To the

extent that the hedges are ineffective for accounting, changes in fair value are recognised in the Statement of Financial Performance.

If a hedging instrument no longer meets the criteria for hedge accounting, expires or is sold, terminated or exercised, or the designation of the hedge

relationship is revoked or changed, then hedge accounting is discontinued. The cumulative gain or loss previously recognised in the cash flow hedge

reserve remains there until the forecast transaction occurs. If the underlying hedged transaction is no longer expected to occur, the cumulative,

unrealised gain or loss recognised in the cash flow hedge reserve with respect to the hedging instrument is recognised immediately in the Statement of

Financial Performance.

Where the hedge relationship continues throughout its designated term, the amount recognised in the cash flow hedge reserve is transferred to the

Statement of Financial Performance in the same period that the hedged item is recorded in the Statement of Financial Performance, or, when the

hedged item is a non-financial asset, the amount recognised in the cash flow hedge reserve is transferred to the carrying amount of the asset when it is

recognised.

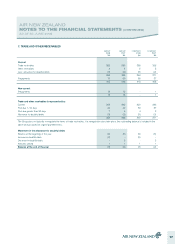

Net investment hedge

Hedges of net investments in foreign operations are accounted for similarly to cash flow hedges. Any gain or loss on the hedging instrument relating to

the effective portion of the hedge is recognised in the foreign currency translation reserve within equity. The gain or loss relating to the ineffective portion

of the hedge is recognised immediately in the Statement of Financial Performance.

Fair value estimation

The fair value of financial instruments traded in active markets is based on quoted market prices at balance date. The fair value of interest-bearing

liabilities for disclosure purposes is calculated based on the present value of future principal and interest cash flows, discounted at the market rate of

interest for similar liabilities at reporting date.

9