Air New Zealand 2008 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2008 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

AS AT 30 JUNE 2008

16. FINANCIAL INSTRUMENTS (CONTINUED)

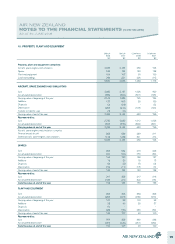

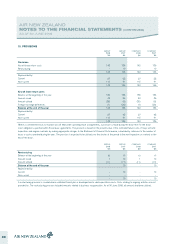

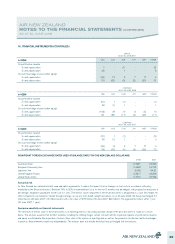

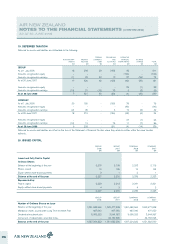

GROUP

AS AT 30 JUNE 2007

In NZ$M USD AUD EUR JPY GBP OTHER

On profit before taxation

5 cents appreciation 7 - (1) - - (3)

5 cents depreciation (8) - 1 - - 3

On cash flow hedge reserve (within equity)

5 cents appreciation (98) 19 5 7 17 6

5 cents depreciation 112 (22) (6) (8) (20) (7)

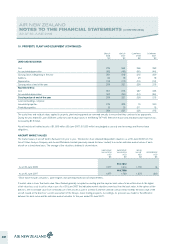

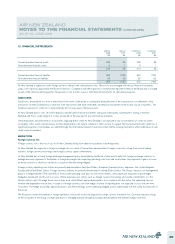

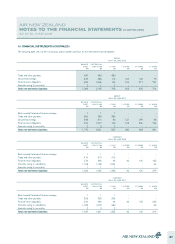

COMPANY

AS AT 30 JUNE 2008

In NZ$M USD AUD EUR JPY GBP OTHER

On profit before taxation

5 cents appreciation (51) 1 (1) - - (1)

5 cents depreciation 58 (1) 1 - - 1

On cash flow hedge reserve (within equity)

5 cents appreciation (168) 29 10 8 22 10

5 cents depreciation 191 (34) (11) (9) (25) (11)

COMPANY

AS AT 30 JUNE 2007

In NZ$M USD AUD EUR JPY GBP OTHER

On profit before taxation

5 cents appreciation (31) 1 (1) - - (2)

5 cents depreciation 36 (1) 1 - - 2

On cash flow hedge reserve (within equity)

5 cents appreciation (95) 19 5 7 17 6

5 cents depreciation 108 (22) (6) (8) (20) (7)

SIGNIFICANT FOREIGN EXCHANGE RATES USED AT BALANCE DATE FOR ONE NEW ZEALAND DOLLAR ARE:

2008 2007

Australian Dollar 0.7921 0.9096

European Community Euro 0.4822 0.5723

Japanese Yen 80.92 94.81

United Kingdom Pound 0.3817 0.3843

United States Dollar 0.7612 0.7698

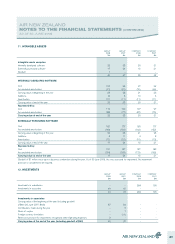

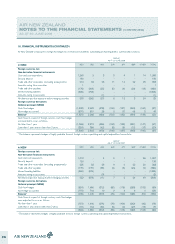

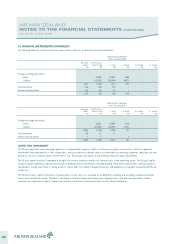

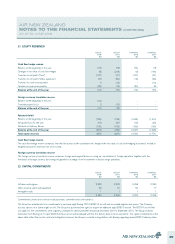

Fuel price risk

Air New Zealand has entered into fuel swap and option agreements to reduce the impact of price changes on fuel costs in accordance with policy

mandated by the Board of directors. Between 75% to 95% of estimated fuel costs for the next 3 months may be hedged, with progressive reductions in

percentages hedged in subsequent months out to 1 year. The intrinsic value component of these fuel derivatives is designated as a cash flow hedge. All

other components are marked to market through earnings, as are any short-dated outright derivatives. As at 30 June 2008, the Group had hedged 3.7

million barrels (30 June 2007: 4.5 million barrels) with a fair value of $176 million (30 June 2007: $22 million). The agreements mature within 1 year

(30 June 2007: 1 year).

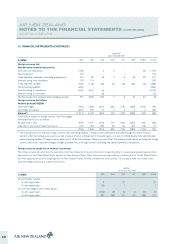

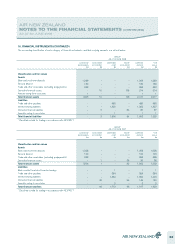

Fuel price sensitivity on financial instruments

The sensitivity of the fair value of these derivatives as at reporting date to a reasonably possible change in the price per barrel of crude oil is shown

below. This analysis assumes that all other variables, including the refining margin, remain constant and the respective impacts on profit before taxation

and equity are dictated by the proportion of intrinsic/time value of the options at reporting date as well as the proportion of effective/ineffective hedges.

In practice, these elements would vary independently. This analysis does not include the future forecast hedged fuel transactions.

29