Air New Zealand 2008 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2008 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

AS AT 30 JUNE 2008

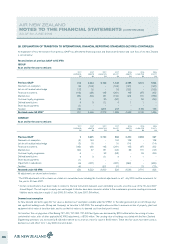

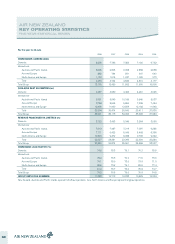

28. EXPLANATION OF TRANSITION TO INTERNATIONAL FINANCIAL REPORTING STANDARDS (NZ IFRS) (CONTINUED)

An explanation of how the transition from previous GAAP has affected the financial position and financial performance and cash flows of Air New Zealand

is set out below:

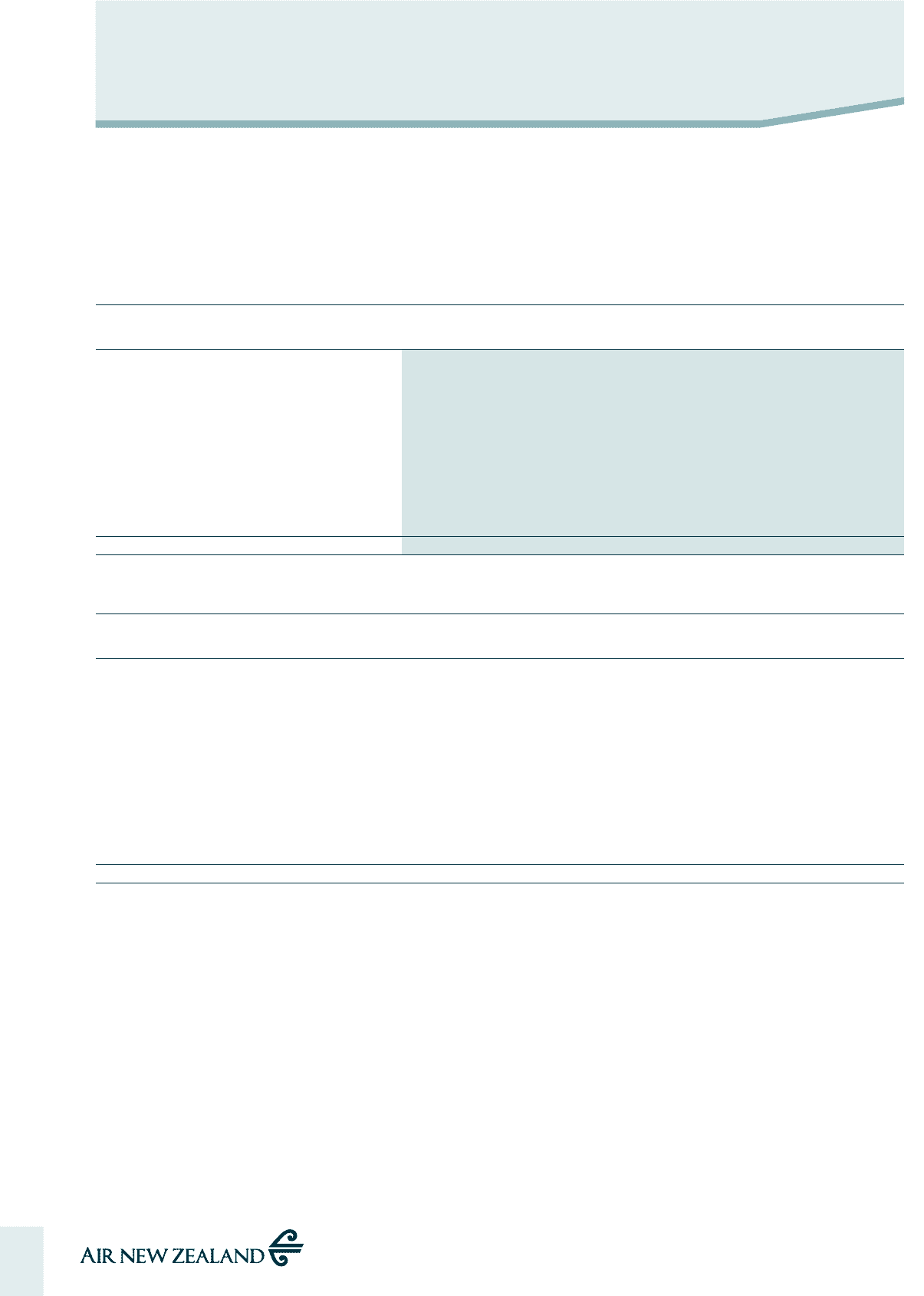

Reconciliations of previous GAAP to NZ IFRS

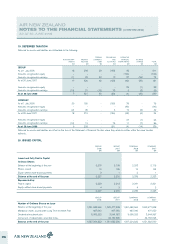

GROUP

As at and for the year to 30 June:

2007

EARNINGS

$M

2007

ASSETS

$M

2007

LIABILITIES

$M

2007

EQUITY*

$M

2006

ASSETS

$M

2006

LIABILITIES

$M

2006

EQUITY

$M

Previous GAAP 214 4,944 3,196 1,748 4,785 3,191 1,594

Deemed cost exemption 33 (154) - (154) (187) - (187)

Jet aircraft residual value hedge 133 18 - 18 (102) - (102)

Financial instruments (118) (86) 145 (231) 165 (37) 202

Maintenance (35) (59) 131 (190) (24) 131 (155)

Customer loyalty programme 9 - 50 (50) - 59 (59)

Defined benefit plans 4 3 (1) 4 1 1 -

Share based payments (1) - - - - - -

Taxation (18) - (243) 243 - (153) 153

Restated under NZ IFRS** 221 4,666 3,278 1,388 4,638 3,192 1,446

COMPANY

As at and for the year to 30 June:

2007

EARNINGS

$M

2007

ASSETS

$M

2007

LIABILITIES

$M

2007

EQUITY*

$M

2006

ASSETS

$M

2006

LIABILITIES

$M

2006

EQUITY

$M

Previous GAAP 9 3,625 2,729 896 3,450 2,483 967

Deemed cost exemption (4) 124 - 124 128 - 128

Jet aircraft residual value hedge (3) 16 - 16 (14) - (14)

Financial instruments (145) (86) 145 (231) 165 (37) 202

Maintenance (20) 67 131 (64) 88 131 (43)

Customer loyalty programme 6 - 53 (53) - 59 (59)

Defined benefit plans 4 3 (1) 4 1 1 -

Share based payments (1) - - - - - -

Impairment in subsidiaries 55 (227) - (227) (282) - (282)

Taxation 46 - (57) 57 - 73 (73)

Restated under NZ IFRS (53) 3,522 3,000 522 3,536 2,710 826

All adjustments are shown before taxation.

* The IFRS adjustments in this column are stated on a cumulative basis including the transitional adjustments as at 1 July 2006 and the movements for

the year to 30 June 2007.

** Certain reclassifications have been made in relation to financial instruments between asset and liability accounts since the issue of the 30 June 2007

Annual Report. The net impact on equity was unchanged. Estimates have been revised in relation to the maintenance provision resulting in increased

liabilities and a reduction in equity (1 July 2006: $1 million; 30 June 2007: $4 million).

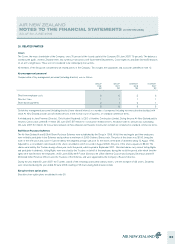

Deemed cost exemption

Air New Zealand elected to apply the “fair value as deemed cost” exemption available under NZ IFRS 1 to the older generation jet aircraft (Group only)

and significant building assets (Group and Company) on transition to NZ IFRS. This exemption allows entities to measure an item of property, plant and

equipment at fair value at transition date, and to use that fair value as its deemed cost from that point forward.

On transition, the carrying value of the Boeing 747-400, 767-300, 737-300 fleet types was decreased by $315 million before tax arriving at a new

combined fair value, after all other applicable NZ IFRS adjustments, of $726 million. The carrying value of buildings associated with the New Zealand

Engineering operations was increased by $128 million before tax to arrive at a new fair value of $180 million. These new fair values have been used as

deemed cost with effect from 1 July 2006 (transition date).

46