Air New Zealand 2008 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2008 Air New Zealand annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AIR NEW ZEALAND

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

AS AT 30 JUNE 2008

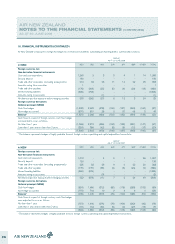

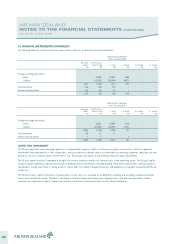

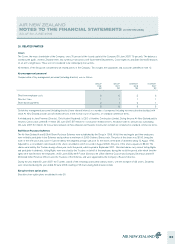

19. DEFERRED TAXATION

Deferred tax assets and liabilities are attributable to the following:

NON-AIRCRAFT

ASSETS

$M

AIRCRAFT

RELATED

$M

FOREIGN

CURRENCY

DEBT

$M

PROVISIONS

AND

ACCRUALS

$M

DERIVATIVE

FINANCIAL

INSTRUMENTS

$M

TAX RATE

CHANGE

$M

TOTAL

$M

GROUP

As at 1 July 2006 18 298 23 (163) 35 - 211

Amounts recognised in equity - - - - (104) - (104)

Amounts recognised in earnings (1) 22 42 10 27 (26) 74

As at 30 June 2007 17 320 65 (153) (42) (26) 181

Amounts recognised in equity - - - - 29 (1) 28

Amounts recognised in earnings (10) 31 (10) 73 9 (3) 90

As at 30 June 2008 7 351 55 (80) (4) (30) 299

COMPANY

As at 1 July 2006 20 185 - (162) 35 - 78

Amounts recognised in equity - - - - (96) - (96)

Amounts recognised in earnings (2) 25 - 6 19 (6) 42

As at 30 June 2007 18 210 - (156) (42) (6) 24

Amounts recognised in equity - - - - 27 (1) 26

Amounts recognised in earnings (12) 19 - 75 11 (7) 86

As at 30 June 2008 6 229 - (81) (4) (14) 136

Deferred tax assets and liabilities are offset on the face of the Statement of Financial Position where they relate to entities within the same taxation

authority.

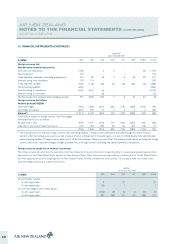

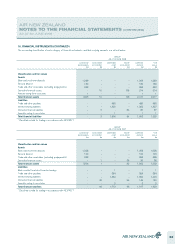

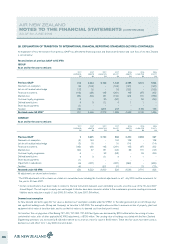

20. ISSUED CAPITAL

GROUP

2008

$M

GROUP

2007

$M

COMPANY

2008

$M

COMPANY

2007

$M

Issued and Fully Paid in Capital

Ordinary Shares

Balance at the beginning of the year 2,215 2,109 2,223 2,118

Shares issued 10 105 10 104

Equity-settled share-based payments 2 1 2 1

Balance at the end of the year 2,227 2,215 2,235 2,223

Represented by:

Paid in capital 2,223 2,213 2,231 2,221

Equity-settled share-based payments 4 2 4 2

2,227 2,215 2,235 2,223

GROUP

2008

GROUP

2007

COMPANY

2008

COMPANY

2007

Number of Ordinary Shares on issue

Balance at the beginning of the year 1,051,682,560 1,003,477,828 1,051,682,560 1,003,477,828

Mandatory shares issued under Long Term Incentive Plan 487,040 407,050 487,040 407,050

Dividend reinvestment plan 5,055,222 3,644,987 5,055,222 3,644,987

Conversion of redeemable convertible notes - 44,152,695 - 44,152,695

Balance at the end of the year 1,057,224,822 1,051,682,560 1,057,224,822 1,051,682,560

36