3M 2014 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2014 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

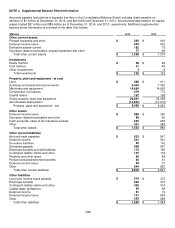

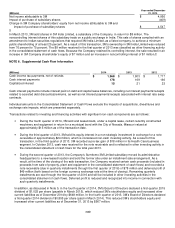

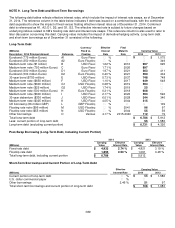

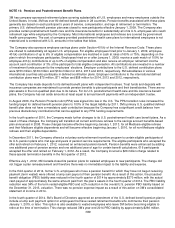

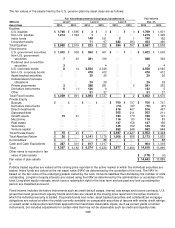

NOTE 9. Long-Term Debt and Short-Term Borrowings

The following debt tables reflects effective interest rates, which include the impact of interest rate swaps, as of December

31, 2014. The reference column in the table below indicates if debt was issued on a combined basis, with the combined

debt separated to show the impact of fixed versus floating effective interest rates as of December 31, 2014. Combined

debt is referenced as A1, A2; D1, D2; and G1, G2. The effective interest rate is subject to future changes based on

underlying indices related to 3M’s floating rate debt and interest rate swaps. This reference column is also used to refer to

later discussion concerning this debt. Carrying value includes the impact of derivative/hedging activity. Long-term debt

and short-term borrowings as of December 31 consisted of the following:

Long

-

Term Debt

Currency/ Effective Final

(Millions) Fixed vs.

Interest

Maturity Carrying Value

Description / 2014 Principal Amount Reference

Floating

Rate

Date 2014 2013

Eurobond (775 million Euros)

A1

Euro Fixed

―

%

―

$

―

$

1,075

Eurobond (250 million Euros)

A2

Euro Floating

―

%

―

―

349

Medium-term note ($1 billion)

B

USD Fixed

1.62

%

2016

997

995

Medium-term note (750 million Euros)

C

Euro Fixed

1.71

%

2026

897

―

Eurobond (300 million Euros)

D1

Euro Fixed

1.97

%

2021

363

411

Eurobond (300 million Euros)

D2

Euro Floating

0.40

%

2021

390

404

30-year bond ($750 million)

E

USD Fixed

5.73

%

2037

748

748

Medium-term note ($650 million)

F

USD Fixed

1.10

%

2017

649

648

Medium-term note ($600 million)

G1

USD Floating

0.28

%

2019

594

―

Medium-term note ($25 million)

G2

USD Fixed

1.74

%

2019

25

―

Medium-term note (500 million Euros)

H

Euro Floating

0.31

%

2018

608

―

Medium-term note ($600 million)

I

USD Fixed

2.17

%

2022

593

592

30-year debenture ($330 million)

J

USD Fixed

6.01

%

2028

344

346

Medium-term note ($325 million)

K

USD Fixed

4.05

%

2044

315

―

UK borrowing (66 million GBP)

L

GBP Floating

―

%

―

―

109

Floating rate note ($96 million)

M

USD Floating

―

%

2041

96

97

Floating rate note ($55 million)

N

USD Floating

―

%

2044

55

59

Other borrowings

O

Various

4.17

%

2015-2040

112

79

Total long-term debt

$

6,786

$

5,912

Less: current portion of long-term debt

55

1,586

Long-term debt (excluding current portion)

$

6,731

$

4,326

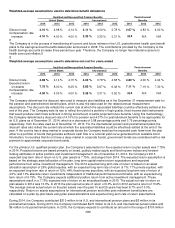

Post-Swap Borrowing (Long-Term Debt, Including Current Portion)

2014

2013

(Millions) Carrying

Value Effective

Interest Rate

Carrying

Value Effective

Interest Rate

Fixed-rate debt

$

4,933

2.74

%

$

4,821

3.19 %

Floating-rate debt

1,853

0.53

%

1,091

0.48 %

Total long-term debt, including current portion

$

6,786

$

5,912

Short

-

Term Borrowings and Current Portion of Long

-

Term Debt

Effective

Carrying Value

(Millions) Interest Rate

2014 2013

Current portion of long-term debt ― %

$

55

$

1,586

U.S. dollar commercial paper ― %

―

―

Other borrowings 2.46 %

51

97

Total short-term borrowings and current portion of long-term debt

$

106

$

1,683