3M 2014 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2014 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

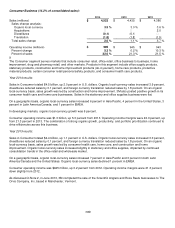

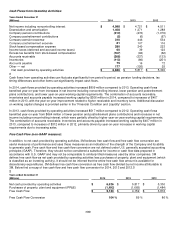

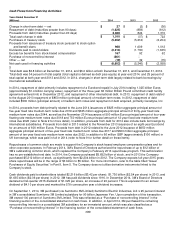

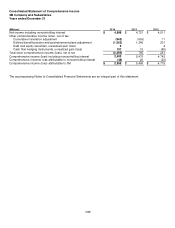

Cash Flows from Financing Activities:

Years Ended December 31

(Millions)

2014

2013

2012

Change in short-term debt — net

$

27

$

(2) $

(36)

Repayment of debt (maturities greater than 90 days)

(1,625)

(859) (612)

Proceeds from debt (maturities greater than 90 days)

2,608

824 1,370

Total cash change in debt

$

1,010

$

(37) $

722

Purchases of treasury stock

(5,652)

(5,212) (2,204)

Proceeds from issuances of treasury stock pursuant to stock option

and benefit plans

968

1,609 1,012

Dividends paid to stockholders

(2,216)

(1,730)

(1,635)

Excess tax benefits from stock-based compensation

167

92 62

Purchase of noncontrolling interest

(861)

― ―

Other — net

(19)

32 (15)

Net cash used in financing activities

$

(6,603)

$

(5,246) $

(2,058)

Total debt was $6.8 billion at December 31, 2014, and $6.0 billion at both December 31, 2013, and December 31, 2012.

Total debt was 34 percent of total capital (total capital is defined as debt plus equity) at year-end 2014, and 25 percent of

total capital at both year-end 2013 and 2012. In 2014, changes in short-term debt largely related to bank borrowings by

international subsidiaries.

In 2014, repayment of debt primarily includes repayment of a Eurobond repaid in July 2014 totaling 1.025 billion Euros

(approximately $1.4 billion carrying value), repayment of the three-year 66 million British Pound committed credit facility

agreement entered into in December 2012, and repayment of other international debt. In 2013, repayment of debt related

to the August 2013 repayment of $850 million (principal amount) of medium-term notes. In 2012, repayment of debt

included $500 million (principal amount) of medium-term notes and repayment of debt acquired, primarily Ceradyne, Inc.

In 2014, proceeds from debt primarily related to the June 2014 issuances of $625 million aggregate principal amount of

five-year fixed rate medium-term notes due 2019 and $325 million aggregate principal amount of thirty-year fixed rate

medium-term notes due 2044, as well as the November 2014 issuances of 500 million Euros principal amount of four-year

floating rate medium-term notes due 2018 and 750 million Euros principal amount of 12-year fixed rate medium-term

notes due 2026 (refer to Note 9 for more detail). In addition, proceeds from debt for 2014 also include bank borrowings by

international subsidiaries. Proceeds from debt in 2013 related to the November 2013 issuance of an eight-year Eurobond

for an amount of 600 million Euros. Proceeds from debt in 2012 related to the June 2012 issuance of $650 million

aggregate principal amount of five-year fixed rate medium-term notes due 2017 and $600 million aggregate principal

amount of ten-year fixed rate medium-term notes due 2022, in addition to 66 million GBP (approximately $106 million) in

UK borrowings, which was paid in full in 2014 (refer to Note 9 for further detail on these items).

Repurchases of common stock are made to support the Company’s stock-based employee compensation plans and for

other corporate purposes. In February 2014, 3M’s Board of Directors authorized the repurchase of up to $12 billion of

3M’s outstanding common stock, which replaced the Company’s February 2013 repurchase program. This authorization

has no pre-established end date. In 2014, the Company purchased $5.652 billion of stock, and in 2013 the Company

purchased $5.212 billion of stock, up significantly from $2.204 billion in 2012. The Company expects full-year 2015 gross

share repurchases will be in the range of $3 billion to $5 billion. For more information, refer to the table titled “Issuer

Purchases of Equity Securities” in Part II, Item 5. The Company does not utilize derivative instruments linked to the

Company’s stock.

Cash dividends paid to shareholders totaled $2.216 billion ($3.42 per share), $1.730 billion ($2.54 per share) in 2013, and

$1.635 billion ($2.36 per share) in 2012. 3M has paid dividends since 1916. In December 2014, 3M’s Board of Directors

declared a first-quarter 2015 dividend of $1.025 per share, an increase of 20 percent. This is equivalent to an annual

dividend of $4.10 per share and marked the 57th consecutive year of dividend increases.

On September 1, 2014, 3M purchased (via Sumitomo 3M Limited) Sumitomo Electric Industries, Ltd.’s 25 percent interest

in 3M’s consolidated Sumitomo 3M Limited subsidiary for 90 billion Japanese Yen. Upon completion of this transaction,

3M owned 100 percent of Sumitomo 3M Limited. This was reflected as a “Purchase of noncontrolling interest” in the

financing section of the consolidated statement of cash flows. In addition, in April 2014, 3M purchased the remaining

noncontrolling interest in a consolidated 3M subsidiary for an immaterial amount, which was also classified as a

“Purchase of noncontrolling interest” in the financing section of the consolidated statement of cash flows.