3M 2014 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2014 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

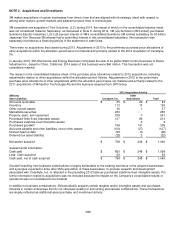

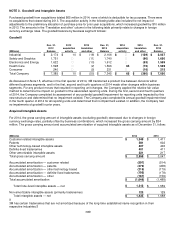

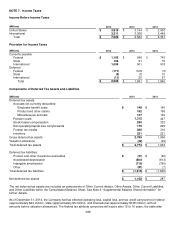

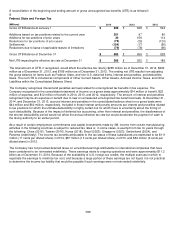

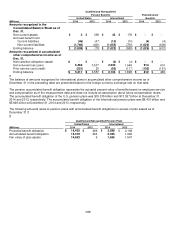

NOTE 7. Income Taxes

Income Before Income Taxes

(Millions)

2014

2013

2012

United States

$

3,815

$ 3,194

$ 2,902

International

3,211

3,368

3,449

Total

$

7,026

$ 6,562

$ 6,351

Provision for Income Taxes

(Millions)

2014

2013

2012

Currently payable

Federal

$

1,103

$ 948

$ 743

State

108

91

75

International

1,008

901

918

Deferred

Federal

(171)

(123)

(3)

State

(9)

(2)

10

International

(11)

26

97

Total

$

2,028

$ 1,841

$ 1,840

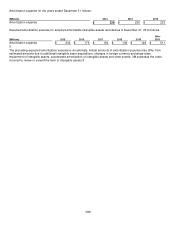

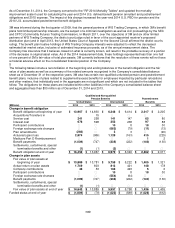

Components of Deferred Tax Assets and Liabilities

(Millions)

2014

2013

Deferred tax assets:

Accruals not currently deductible

Employee benefit costs $

148

$

140

Product and other claims 152

155

Miscellaneous accruals 137

130

Pension costs 1,312

447

Stock-based compensation 290

322

Net operating/capital loss carryforwards 175

225

Foreign tax credits 360

316

Inventory 221

221

Gross deferred tax assets 2,795

1,956

Valuation allowance

(22)

(23)

Total deferred tax assets $

2,773

$

1,933

Deferred tax liabilities:

Product and other insurance receivables $

(31)

$

(46)

Accelerated depreciation

(804)

(813)

Intangible amortization

(719)

(780)

Other

(61)

(7)

Total deferred tax liabilities $

(1,615)

$

(1,646)

Net deferred tax assets $

1,158

$

287

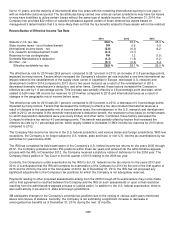

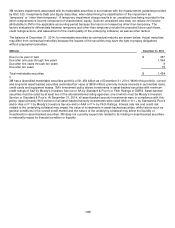

The net deferred tax assets are included as components of Other Current Assets, Other Assets, Other Current Liabilities,

and Other Liabilities within the Consolidated Balance Sheet. See Note 4 “Supplemental Balance Sheet Information” for

further details.

As of December 31, 2014, the Company had tax effected operating loss, capital loss, and tax credit carryovers for federal

(approximately $24 million), state (approximately $3 million), and international (approximately $148 million), with all

amounts before valuation allowances. The federal tax attribute carryovers will expire after 15 to 16 years, the state after