3M 2014 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2014 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

these amounts ultimately proves to be less than the recorded amounts, the reversal of the liabilities would result in tax

benefits being recognized in the period when the Company determines the liabilities are no longer necessary.

NEW ACCOUNTING PRONOUNCEMENTS

Information regarding new accounting pronouncements is included in Note 1 to the Consolidated Financial Statements.

FINANCIAL CONDITION AND LIQUIDITY

3M continues to manage towards a better-optimized capital structure by adding balance sheet leverage, which is being

used for two purposes: first, to invest in 3M’s businesses, and second, to increase cash returns to shareholders. The

strength and stability of 3M's business model and strong free cash flow capability, together with proven capital markets

access, enables 3M to implement this strategy while continuing to invest in its businesses. Organic growth remains a high

priority, thus 3M will continue to invest in research and development, capital expenditures, and commercialization

capability. In addition, sources for cash availability in the United States, such as ongoing cash flow from operations and

access to capital markets, have historically been sufficient to fund dividend payments to shareholders and share

repurchases, as well as funding U.S. acquisitions and other items as needed. For those international earnings considered

to be reinvested indefinitely, the Company currently has no plans or intentions to repatriate these funds for U.S.

operations. However, if these international funds are needed for operations in the U.S., 3M would be required to accrue

and pay U.S. taxes to repatriate them. See Note 7 for further information on earnings considered to be reinvested

indefinitely.

3M’s primary short-term liquidity needs are met through cash on hand and U.S. commercial paper issuances. 3M

resumed commercial paper funding in July 2013 for the first time since late 2008. 3M expects to maintain a consistent

presence in the market and believes it will have continuous access to the commercial paper market. 3M’s commercial

paper program permits the Company to have a maximum of $3 billion outstanding with a maximum maturity of 397 days

from date of issuance.

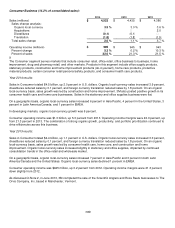

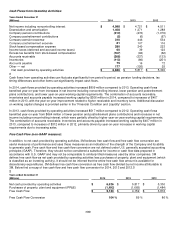

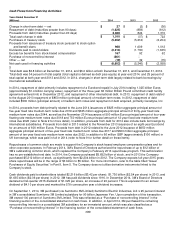

Net Debt:

The Company defines net debt as total debt less the total of cash, cash equivalents and current and long-term marketable

securities. 3M considers net debt and its components to be an important indicator of liquidity and a guiding measure of

capital structure strategy. Net debt is not defined under U.S. generally accepted accounting principles and may not be

computed the same as similarly titled measures used by other companies. The following table provides net debt as of

December 31, 2014 and 2013.

At December 31

(Millions)

2014

2013

Total Debt

$

6,837

$

6,009

Less: Cash and cash equivalents and marketable securities

3,351

4,790

Net Debt

$

3,486

$

1,219

In 2014, net debt increased by $2.3 billion to a net debt balance of $3.5 billion (as of December 31, 2014), as 3M

progressed on its capital structure strategy and experienced higher debt levels and lower cash balances in both the U.S.

and internationally. Specific actions related to cash, cash equivalents, and marketable securities, in addition to debt, are

discussed further below.

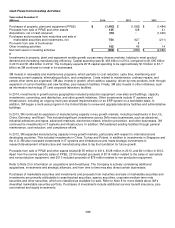

Cash, cash equivalents and marketable securities:

At December 31, 2014, 3M had $3.4 billion of cash, cash equivalents and marketable securities, of which approximately

$3.3 billion was held by the Company’s foreign subsidiaries and less than $100 million was held by the United States. Of

the $3.3 billion held internationally, U.S. dollar-based cash, cash equivalents and marketable securities totaled $1.9

billion, or 58 percent, which was invested in money market funds, asset-backed securities, agency securities, corporate

medium-term note securities and other high quality fixed income securities. At December 31, 2013, cash, cash

equivalents and marketable securities held by the Company’s foreign subsidiaries and in the United States totaled

approximately $4.3 billion and $0.5 billion, respectively.