3M 2014 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2014 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

five to 10 years, and the majority of international after five years with the remaining international expiring in one year or

with an indefinite carryover period. The tax attributes being carried over arise as certain jurisdictions may have tax losses

or may have inabilities to utilize certain losses without the same type of taxable income. As of December 31, 2014, the

Company has provided $22 million of valuation allowance against certain of these deferred tax assets based on

management's determination that it is more-likely-than-not that the tax benefits related to these assets will not be realized.

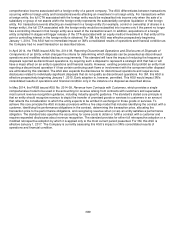

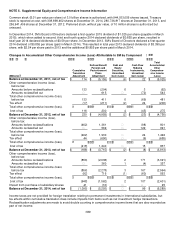

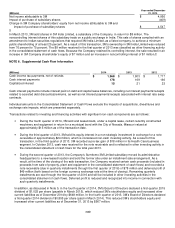

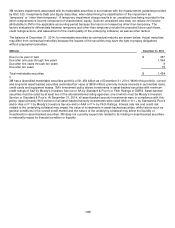

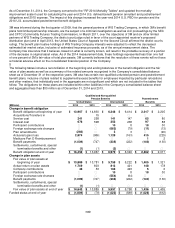

Reconciliation of Effective Income Tax Rate

2014 2013

2012

Statutory U.S. tax rate

35.0

%

35.0

%

35.0

%

State income taxes - net of federal benefit

0.9

0.9

0.9

International income taxes - net

(5.8)

(6.3)

(4.2)

U.S. research and development credit

(0.4)

(0.7)

-

Reserves for tax contingencies

0.6

1.2

(1.9)

Domestic Manufacturer's deduction

(1.3)

(1.6)

(1.2)

All other - net

(0.1)

(0.4)

0.4

Effective worldwide tax rate

28.9

%

28.1

%

29.0

%

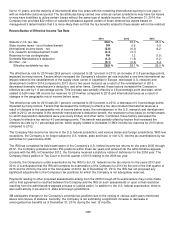

The effective tax rate for 2014 was 28.9 percent, compared to 28.1 percent in 2013, an increase of 0.8 percentage points,

impacted by many factors. Factors which increased the Company’s effective tax rate included a one-time international tax

impact related to the establishment of the supply chain center of expertise in Europe, decreased U.S. research and

development credit in 2014 compared to 2013 due to two years inclusion as a result of the reinstatement in 2013,

decreased domestic manufacturer’s deduction, and other items. Combined, these factors increased the Company’s

effective tax rate by 1.6 percentage points. This increase was partially offset by a 0.8 percentage point decrease, which

related to both lower 3M income tax reserves for 2014 when compared to 2013 and international taxes as a result of

changes to the geographic mix of income before taxes.

The effective tax rate for 2013 was 28.1 percent, compared to 29.0 percent in 2012, a decrease of 0.9 percentage points,

impacted by many factors. Factors that decreased the Company’s effective tax rate included international taxes as a

result of changes to the geographic mix of income before taxes, the reinstatement of the U.S. research and development

credit in 2013, an increase in the domestic manufacturer’s deduction benefit, the restoration of tax basis on certain assets

for which depreciation deductions were previously limited, and other items. Combined, these factors decreased the

Company’s effective tax rate by 4.0 percentage points. This benefit was partially offset by factors that increased the

effective tax rate by 3.1 percentage points, which largely related to increases in 3M’s income tax reserves for 2013 when

compared to 2012.

The Company files income tax returns in the U.S. federal jurisdiction, and various states and foreign jurisdictions. With few

exceptions, the Company is no longer subject to U.S. federal, state and local, or non-U.S. income tax examinations by tax

authorities for years before 2005.

The IRS has completed its field examination of the Company’s U.S. federal income tax returns for the years 2005 through

2012. The Company protested certain IRS positions within these tax years and entered into the administrative appeals

process with the IRS. In December 2012, the Company received a statutory notice of deficiency for the 2006 year. The

Company filed a petition in Tax Court in the first quarter of 2013 relating to the 2006 tax year.

Currently, the Company is under examination by the IRS for its U.S. federal income tax returns for the years 2013 and

2014. It is anticipated that the IRS will complete its examination of the Company for 2013 by the end of the first quarter of

2015 and for 2014 by the end of the first quarter of 2016. As of December 31, 2014, the IRS has not proposed any

significant adjustments to the Company’s tax positions for which the Company is not adequately reserved.

Payments relating to other proposed assessments arising from the 2005 through 2014 examinations may not be made

until a final agreement is reached between the Company and the IRS on such assessments or upon a final resolution

resulting from the administrative appeals process or judicial action. In addition to the U.S. federal examination, there is

also audit activity in several U.S. state and foreign jurisdictions.

3M anticipates changes to the Company’s uncertain tax positions due to the closing of various audit years mentioned

above and closure of statutes. Currently, the Company is not estimating a significant increase or decrease in

unrecognized tax benefits as of December 31, 2014, during the next 12 months.