3M 2014 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2014 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.62

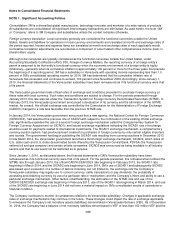

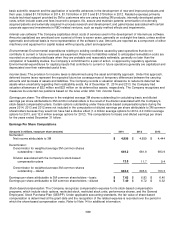

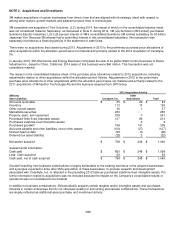

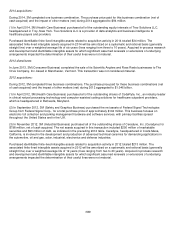

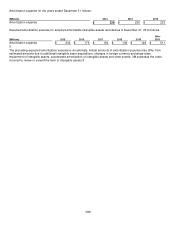

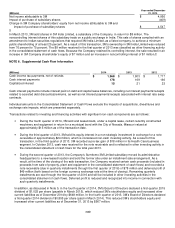

2014 acquisitions:

During 2014, 3M completed one business combination. The purchase price paid for this business combination (net of

cash acquired) and the impact of other matters (net) during 2014 aggregated to $94 million.

(1) In April 2014, 3M (Health Care Business) purchased all of the outstanding equity interests of Treo Solutions LLC,

headquartered in Troy, New York. Treo Solutions LLC is a provider of data analytics and business intelligence to

healthcare payers and providers.

Purchased identifiable finite-lived intangible assets related to acquisition activity in 2014 totaled $34 million. The

associated finite-lived intangible assets acquired in 2014 will be amortized on a systematic and rational basis (generally

straight line) over a weighted-average life of six years (lives ranging from three to 10 years). Acquired in-process research

and development and identifiable intangible assets for which significant assumed renewals or extensions of underlying

arrangements impacted the determination of their useful lives were not material.

2013 divestitures:

In June 2013, 3M (Consumer Business) completed the sale of its Scientific Anglers and Ross Reels businesses to The

Orvis Company, Inc. based in Manchester, Vermont. This transaction was not considered material.

2012 acquisitions:

During 2012, 3M completed three business combinations. The purchase price paid for these business combinations (net

of cash acquired) and the impact of other matters (net) during 2012 aggregated to $1.046 billion.

(1) In April 2012, 3M (Health Care Business) purchased all of the outstanding shares of CodeRyte, Inc., an industry leader

in clinical natural processing technology and computer-assisted coding solutions for healthcare outpatient providers,

which is headquartered in Bethesda, Maryland.

(2) In September 2012, 3M (Safety and Graphics Business) purchased the net assets of Federal Signal Technologies

Group from Federal Signal Corp., for a total purchase price of approximately $104 million. This business focuses on

electronic toll collection and parking management hardware and software services, with primary facilities spread

throughout the United States and in the U.K.

(3) In November 2012, 3M (Industrial Business) purchased all of the outstanding shares of Ceradyne, Inc. (Ceradyne) for

$798 million, net of cash acquired. The net assets acquired in this transaction included $250 million of marketable

securities and $93 million of debt, as indicated in the preceding 2012 table. Ceradyne, headquartered in Costa Mesa,

California, is involved in the development and production of advanced technical ceramics for demanding applications in

the automotive, oil and gas, solar, industrial, electronics and defense industries.

Purchased identifiable finite-lived intangible assets related to acquisition activity in 2012 totaled $213 million. The

associated finite-lived intangible assets acquired in 2012 will be amortized on a systematic and rational basis (generally

straight line) over a weighted-average life of 12 years (lives ranging from two to 20 years). Acquired in-process research

and development and identifiable intangible assets for which significant assumed renewals or extensions of underlying

arrangements impacted the determination of their useful lives were not material.