3M 2014 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2014 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.42

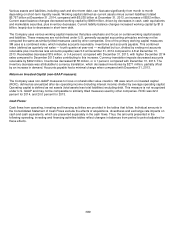

out in cash in the next 12 months. The Company is not able to reasonably estimate the timing of the long-term payments

or the amount by which the liability will increase or decrease over time; therefore, the long-term portion of the net tax

liability of $262 million is excluded from the preceding table. Refer to Note 7 for further details.

As discussed in Note 10, the Company does not have a required minimum cash pension contribution obligation for its

U.S. plans in 2015 and Company contributions to its U.S. and international pension plans are expected to be largely

discretionary in future years; therefore, amounts related to these plans are not included in the preceding table.

FINANCIAL INSTRUMENTS

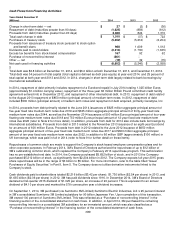

The Company enters into foreign exchange forward contracts, options and swaps to hedge against the effect of exchange

rate fluctuations on cash flows denominated in foreign currencies and certain intercompany financing transactions. The

Company manages interest rate risks using a mix of fixed and floating rate debt. To help manage borrowing costs, the

Company may enter into interest rate swaps. Under these arrangements, the Company agrees to exchange, at specified

intervals, the difference between fixed and floating interest amounts calculated by reference to an agreed-upon notional

principal amount. The Company manages commodity price risks through negotiated supply contracts, price protection

agreements and forward contracts.

Refer to Item 7A, “Quantitative and Qualitative Disclosures About Market Risk”, for further discussion of foreign exchange

rates risk, interest rates risk, commodity prices risk and value at risk analysis.