3M 2014 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2014 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

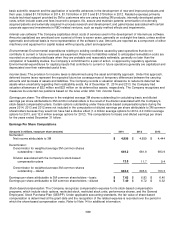

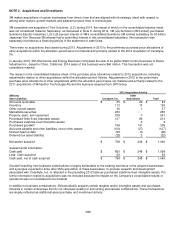

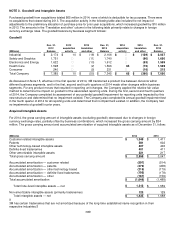

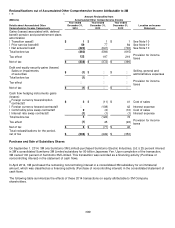

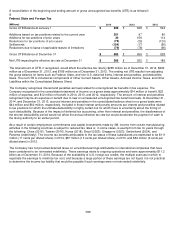

NOTE 4. Supplemental Balance Sheet Information

Accounts payable (included as a separate line item in the Consolidated Balance Sheet) includes drafts payable on

demand of $1 million at December 31, 2014, and $24 million at December 31, 2013. Accumulated depreciation for capital

leases totaled $87 million and $85 million as of December 31, 2014, and 2013, respectively. Additional supplemental

balance sheet information is provided in the table that follows.

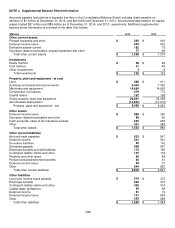

(Millions)

2014

2013

Other current assets

Prepaid expenses and other

$

595

$

602

Deferred income taxes

444

502

Derivative assets-current

182

76

Insurance related receivables, prepaid expenses and other

77

99

Total other current assets

$

1,298

$

1,279

Investm

ents

Equity method

$

58

$

69

Cost method

41

45

Other investments

3

8

Total investments

$

102

$

122

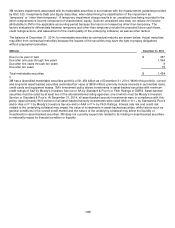

Property, plant and equipment

-

at cost

Land

$

368

$

411

Buildings and leasehold improvements

6,943

7,062

Machinery and equipment

14,684

14,665

Construction in progress

679

772

Capital leases

167

158

Gross property, plant and equipment

22,841

23,068

Accumulated depreciation

(14,352)

(14,416)

Property, plant and equipment - net

$

8,489

$

8,652

Other assets

Deferred income taxes

$

889

$

360

Insurance related receivables and other

89

96

Cash surrender value of life insurance policies

245

236

Other

331

288

Total other assets

$

1,554

$

980

Other current liabilities

Accrued trade payables

$

533

$

547

Deferred income

541

521

Derivative liabilities

39

103

Dividends payable

648

567

Employee benefits and withholdings

172

195

Contingent liability claims and other

157

119

Property and other taxes

90

88

Pension and postretirement benefits

60

61

Deferred income taxes

34

37

Other

644

653

Total other current liabilities

$

2,918

$

2,891

Other liabilities

Long term income taxes payable

$

519

$

472

Employee benefits

262

315

Contingent liability claims and other

300

314

Capital lease obligations

59

58

Deferred income

21

19

Deferred income taxes

141

538

Other

253

268

Total other liabilities

$

1,555

$

1,984