3M 2014 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2014 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111

NOTE 14. Stock-Based Compensation

The 3M 2008 Long-Term Incentive Plan provides for the issuance or delivery of up to 100 million shares of 3M common

stock (including additional shareholder approvals subsequent to 2008) pursuant to awards granted under the plan.

Awards under this plan may be issued in the form of incentive stock options, nonqualified stock options, progressive stock

options, stock appreciation rights, restricted stock, restricted stock units, other stock awards, and performance units and

performance shares. Awards denominated in shares of common stock other than options and stock appreciation rights,

per the 2008 Plan, count against the 100 million share limit as 3.38 shares for every one share covered by such award

(for full value awards with grant dates prior to May 11, 2010), as 2.87 shares for every one share covered by such award

(for full value awards with grant dates on or after May 11, 2010, and prior to May 8, 2012), or as 3.50 shares for every one

share covered by such award (for full value awards with grant dates of May 8, 2012 or later). The remaining total shares

available for grant under the 2008 Long Term Incentive Plan Program are 28,293,674 as of December 31, 2014. There

were approximately 9,525 participants with outstanding options, restricted stock, or restricted stock units at December 31,

2014.

The Company’s annual stock option and restricted stock unit grant is made in February to provide a strong and immediate

link between the performance of individuals during the preceding year and the size of their annual stock compensation

grants. The grant to eligible employees uses the closing stock price on the grant date. Accounting rules require

recognition of expense under a non-substantive vesting period approach, requiring compensation expense recognition

when an employee is eligible to retire. Employees are considered eligible to retire at age 55 and after having completed

five years of service. This retiree-eligible population represents 33 percent of the 2014 annual stock-based compensation

award expense dollars; therefore, higher stock-based compensation expense is recognized in the first quarter. 3M also

has granted progressive (reload) options. These options are nonqualified stock options that were granted to certain

participants under the 1997 or 2002 Management Stock Ownership Program, but for which the reload feature was

eliminated in 2005 (on a prospective basis only).

In addition to the annual grants, the Company makes other minor grants of stock options, restricted stock units and other

stock-based grants. The Company issues cash settled restricted stock units and stock appreciation rights in certain

countries. These grants do not result in the issuance of common stock and are considered immaterial by the Company.

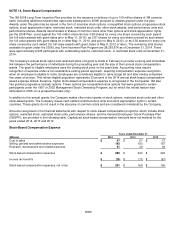

Amounts recognized in the financial statements with respect to stock-based compensation programs, which include stock

options, restricted stock, restricted stock units, performance shares, and the General Employees’ Stock Purchase Plan

(GESPP), are provided in the following table. Capitalized stock-based compensation amounts were not material for the

years ended 2014, 2013 and 2012.

Stock

-

Based Compensation Expense

Years ended December 31

(Millions)

2014

2013

2012

Cost of sales

$

47

$

27 $

27

Selling, general and administrative expenses

192

183 167

Research, development and related expenses

41

30 29

Stock-based compensation expenses

$

280

$

240 $

223

Income tax benefits

$

(79)

$

(71) $

(67)

Stock-based compensation expenses, net of tax

$

201

$

169 $

156