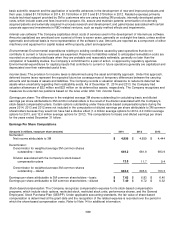

3M 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

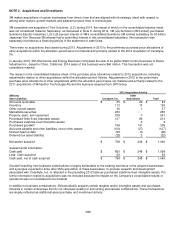

53

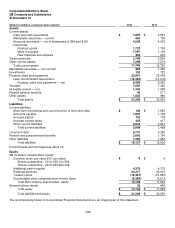

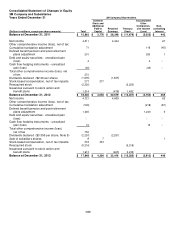

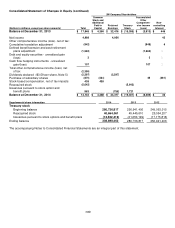

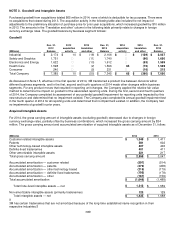

Consolidated S

tatement of Cash Flows

3M Company and Subsidiaries

Years ended December 31

(Millions)

2014

2013

2012

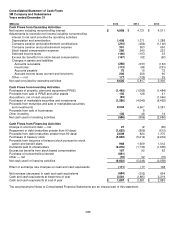

Cash Flows from Operating Activities

Net income including noncontrolling interest

$

4,998

$

4,721 $

4,511

Adjustments to reconcile net income including noncontrolling

interest to net cash provided by operating activities

Depreciation and amortization

1,408

1,371 1,288

Company pension and postretirement contributions

(215)

(482)

(1,146)

Company pension and postretirement expense

391

553 650

Stock-based compensation expense

280

240 223

Deferred income taxes

(146)

(167)

33

Excess tax benefits from stock-based compensation

(167)

(92)

(62)

Changes in assets and liabilities

Accounts receivable

(268)

(337)

(133)

Inventories

(113)

(86)

(251)

Accounts payable

75

16

72

Accrued income taxes (current and long-term)

206

206 90

Other — net

177

(126)

25

Net cash provided by operating activities

6,626

5,817 5,300

Cash Flows from Investing Activities

Purchases of property, plant and equipment (PP&E)

(1,493)

(1,665)

(1,484)

Proceeds from sale of PP&E and other assets

135

128 41

Acquisitions, net of cash acquired

(94)

―

(1,046)

Purchases of marketable securities and investments

(1,280)

(4,040)

(5,492)

Proceeds from maturities and sale of marketable securities

and investments

2,034

4,667 5,281

Proceeds from sale of businesses

―

8 ―

Other investing

102

46

14

Net cash used in investing activities

(5

96)

(856)

(2,686)

Cash Flows from Financing Activities

Change in short-term debt — net

27

(2)

(36)

Repayment of debt (maturities greater than 90 days)

(1,625)

(859)

(6

12)

Proceeds from debt (maturities greater than 90 days)

2,608

824 1,370

Purchases of treasury stock

(5,652)

(5,212)

(2,204)

Proceeds from issuance of treasury stock pursuant to stock

option and benefit plans

968

1,609 1,012

Dividends paid to shareholders

(2,216)

(1,730)

(1,635)

Excess tax benefits from stock-based compensation

167

92 62

Purchase of noncontrolling interest

(861)

― ―

Other — net

(19)

32

(15)

Net cash used in financing activities

(6,603)

(5,246)

(2,058)

Effect of exchange rate changes on cash and cash equivalents

(111)

(17)

108

Net increase (decrease) in cash and cash equivalents

(684)

(302)

664

Cash and cash equivalents at beginning of year

2,581

2,883 2,219

Cash and cash equivalents at end of year

$

1,897

$

2,581 $

2,883

The accompanying Notes to Consolidated Financial Statements are an integral part of this statement.