3M 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

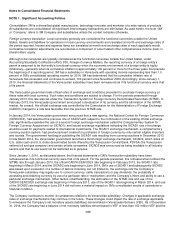

NOTE 2. Acquisitions and Divestitures

3M makes acquisitions of certain businesses from time to time that are aligned with its strategic intent with respect to,

among other factors, growth markets and adjacent product lines or technologies.

3M completed one acquisition (Treo Solutions, LLC) during 2014, the impact of which on the consolidated balance sheet

was not considered material. Separately, as discussed in Note 5, during 2014, 3M (via Sumitomo 3M Limited) purchased

Sumitomo Electric Industries, Ltd.’s 25 percent interest in 3M’s consolidated Sumitomo 3M Limited subsidiary for 90 billion

Japanese Yen. Because 3M already had a controlling interest in this consolidated subsidiary, this transaction was

separately recorded as a financing activity in the statement of cash flows.

There were no acquisitions that closed during 2013. Adjustments in 2013 to the preliminary purchase price allocations of

other acquisitions within the allocation period were not material and primarily related to the 2012 acquisition of Ceradyne,

Inc.

In January 2015, 3M (Electronics and Energy Business) completed the sale of its global Static Control business to Desco

Industries Inc., based in Chino, California. 2014 sales of this business were $46 million. This transaction was not

considered material.

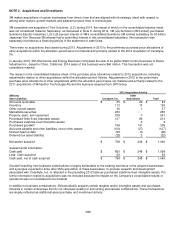

The impact on the consolidated balance sheet of the purchase price allocations related to 2012 acquisitions, including

adjustments relative to other acquisitions within the allocation period, follows. Adjustments in 2012 to the preliminary

purchase price allocations of other acquisitions within the allocation period were not material and primarily related to the

2011 acquisitions of Winterthur Technologie AG and the business acquired from GPI Group.

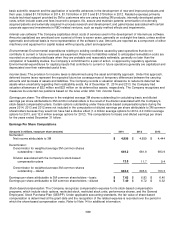

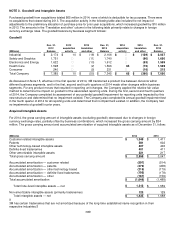

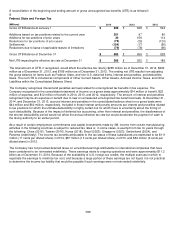

2012 Acquisition Activity

(Millions)

Other

Total Asset (Liability) Ceradyne, Inc. Acquisitions

Accounts receivable $

55 $

29 $

84

Inventory 112 13 125

Other current assets 36 1 37

Marketable securities 250 ― 250

Property, plant, and equipment 238 3 241

Purchased finite-lived intangible assets 127 86 213

Purchased indefinite-lived intangible assets ― 2 2

Purchased goodwill 198 141 339

Accounts payable and other liabilities, net of other assets (100) (27) (127)

Interest bearing debt (93) (3) (96)

Deferred tax asset/(liability) (25) 3 (22)

Net assets acquired $

798 $

248 $

1,046

Supplemental information:

Cash paid $

850 $

248 $

1,098

Less: Cash acquired 52 ― 52

Cash paid, net of cash acquired $

798 $

248 $

1,046

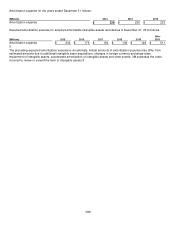

Goodwill resulting from business combinations is largely attributable to the existing workforce of the acquired businesses

and synergies expected to arise after 3M’s acquisition of these businesses. In-process research and development

associated with CodeRyte, Inc. is reflected in the preceding 2012 table as purchased indefinite-lived intangible assets. Pro

forma information related to acquisitions was not included because the impact on the Company’s consolidated results of

operations was not considered to be material.

In addition to business combinations, 3M periodically acquires certain tangible and/or intangible assets and purchases

interests in certain enterprises that do not otherwise qualify for accounting as business combinations. These transactions

are largely reflected as additional asset purchase and investment activity.