3M 2014 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2014 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

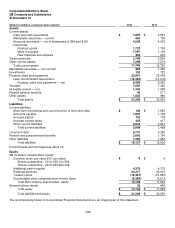

52

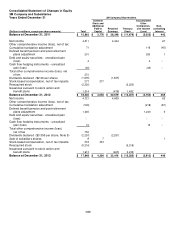

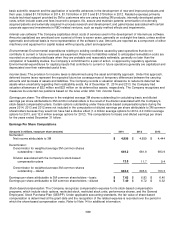

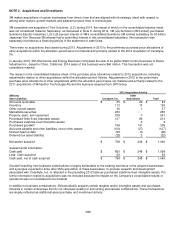

Consolidated Statement of Changes in Equity (continued)

3M Company Shareholders

(Dollars in millions, except per share amounts)

Total

Common

Stock and

Additional

Paid-in

Capital

Retained

Earnings

Treasury

Stock

Accumulated

Other

Comprehen-

sive Income

(Loss)

Non-

controlling

Interest

Balance at December 31, 2013

$

17,948

$

4,384

$

32,416

$

(15,385)

$

(3,913)

$

446

Net income

4,998

4,956

42

Other comprehensive income (loss), net of tax:

Cumulative translation adjustment

(942)

(948)

6

Defined benefit pension and post-retirement

plans adjustment

(1,562)

(1,562)

―

Debt and equity securities - unrealized gain

(loss)

2

2

―

Cash flow hedging instruments - unrealized

gain/(loss)

107

107

―

Total other comprehensive income (loss), net

of tax

(2,395)

Dividends declared ($3.59 per share, Note 5)

(2,297)

(2,297)

Purchase of subsidiary shares

(870)

(434)

25

(461)

Stock-based compensation, net of tax impacts

438

438

Reacquired stock

(5,643)

(5,643)

Issuances pursuant to stock option and

benefit plans

963

(758)

1,721

Balance at December 31, 2014

$

13,142

$

4,388

$

34,317

$

(19,307)

$

(6,289)

$

33

Supplemental share information

2014 2013

2012

Treasury stock

Beginning balance 280,736,817 256,941,406 249,063,015

Reacquired stock 40,664,061 45,445,610 25,054,207

Issuances pursuant to stock options and benefit plans (12,502,416) (21,650,199) (17,175,816)

Ending balance 308,898,462 280,736,817 256,941,406

The accompanying Notes to Consolidated Financial Statements are an integral part of this statement.