3M 2014 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2014 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

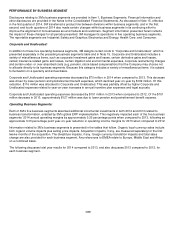

Operating income decreased 7.0 percent to $954 million in 2013. Operating income margins were 17.7 percent, compared

to 18.8 percent in 2012. The operating margin decline was primarily attributable to lower factory utilization and flat year-

on-year organic local-currency sales.

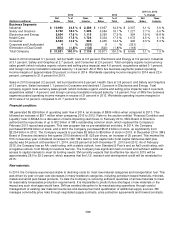

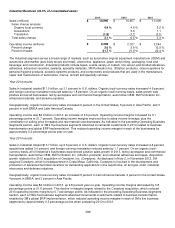

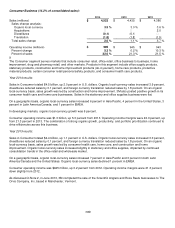

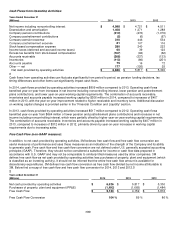

Health Care Business (17.5% of consolidated sales):

2014

2013 2012

Sales (millions)

$

5,572

$

5,334

$

5,138

Sales change analysis:

Organic local currency

5.8

%

5.0

%

4.7

%

Acquisitions

0.

4

0.1

0.3

Translation

(1.7)

(1.3)

(2.5)

Total sales change

4.5

%

3.8

%

2.5

%

Operating income (millions)

$

1,724

$

1,672

$

1,641

Percent change

3.1

%

1.9

%

10.5

%

Percent of sales

30.9

%

31.3

%

31.9

%

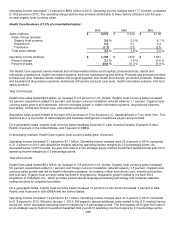

The Health Care segment serves markets that include medical clinics and hospitals, pharmaceuticals, dental and

orthodontic practitioners, health information systems, and food manufacturing and testing. Products and services provided

to these and other markets include medical and surgical supplies, skin health and infection prevention products, inhalation

and transdermal drug delivery systems, dental and orthodontic products (oral care), health information systems, and food

safety products.

Year 2014 results:

Health Care sales totaled $5.6 billion, an increase of 4.5 percent in U.S. dollars. Organic local-currency sales increased

5.8 percent, acquisitions added 0.4 percent, and foreign currency translation reduced sales by 1.7 percent. Organic local-

currency sales grew in all businesses, with the strongest growth in health information systems, drug delivery systems,

food safety, critical and chronic care, and infection prevention.

Acquisition sales growth related to the April 2014 purchase of Treo Solutions LLC, headquartered in Troy, New York. Treo

Solutions LLC is a provider of data analytics and business intelligence to healthcare payers and providers.

On a geographic basis, organic local-currency sales increased 9 percent in Latin America/Canada, 8 percent in Asia

Pacific, 6 percent in the United States, and 3 percent in EMEA.

In developing markets, Health Care organic local-currency sales grew 12 percent.

Operating income increased 3.1 percent to $1.7 billion. Operating income margins were 30.9 percent in 2014, compared

to 31.3 percent in 2013, with acquisition impacts reducing operating income margins by 0.3 percentage points. As

discussed below in 2013 results, the gain from sale of a non-strategic equity method investment benefited total year 2013

operating income margins by 0.3 percentage points.

Year 2013 results:

Health Care sales totaled $5.3 billion, an increase of 3.8 percent in U.S. dollars. Organic local-currency sales increased

5.0 percent, acquisitions added 0.1 percent, and foreign currency translation reduced sales by 1.3 percent. Organic local-

currency sales growth was led by health information systems, food safety, critical and chronic care, infection prevention,

and oral care. Organic local-currency sales declined in drug delivery. Acquisition growth related to the April 2012

acquisition of CodeRyte, Inc., which provides clinical natural language processing technology and computer-assisted

coding solutions for outpatient providers.

On a geographic basis, organic local-currency sales increased 10 percent in Latin America/Canada, 8 percent in Asia

Pacific, and 4 percent in both EMEA and the United States.

Operating income increased 1.9 percent to $1.7 billion. Operating income margins were 31.3 percent in 2013, compared

to 31.9 percent in 2012. Effective January 1, 2013, 3M began to absorb additional costs related to the U.S. medical device

excise tax, which decreased operating income margins by 0.4 percentage points. The third-quarter 2013 gain from sale of

a non-strategic equity method investment benefited total year 2013 operating income margins by 0.3 percentage points.