3M 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

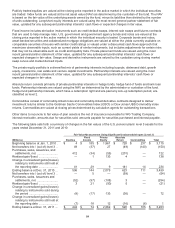

Publicly traded equities are valued at the closing price reported in the active market in which the individual securities

are traded. Index funds are valued at the NAV as determined by the custodian of the fund. The NAV is based on the

fair value of the underlying assets owned by the fund, minus its liabilities then divided by the number of units

outstanding. Long/short equity interests are valued using the most recent general partner statement of fair value,

updated for any subsequent partnership interests’ cash flows or expected changes in fair value.

Fixed income includes derivative investments such as credit default swaps, interest rate swaps and futures contracts

that are used to help manage risks. U.S. government and government agency bonds and notes are valued at the

closing price reported in the active market in which the individual security is traded. Corporate bonds and notes,

asset backed securities and collateralized mortgage obligations are valued at either the yields currently available on

comparable securities of issuers with similar credit ratings or valued under a discounted cash flows approach that

maximizes observable inputs, such as current yields of similar instruments, but includes adjustments for certain risks

that may not be observable such as credit and liquidity risks. Swaps and derivative instruments are valued by the

custodian using market swap curves and market derived inputs.

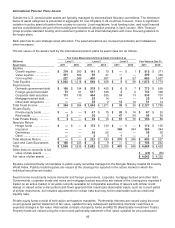

The private equity portfolio is a diversified mix of partnership interests including buyouts, distressed debt, growth

equity, mezzanine, real estate and venture capital investments. Partnership interests are valued using the most

recent general partner statement of fair value, updated for any subsequent partnership interests’ cash flows or

expected changes in fair value.

Absolute return primarily consists of private partnership interests in hedge funds, hedge fund of funds and bank loan

funds. Partnership interests are valued using the NAV as determined by the independent administrator or custodian

of the fund.

Commodities consist of commodity-linked notes and commodity-linked derivative contracts designed to deliver

investment returns similar to the GSCI or Dow Jones UBS Commodity index returns. Commodities are valued at

closing prices determined by calculation agents for outstanding transactions.

Other items to reconcile to fair value of plan assets is the net of interest receivable, amounts due for securities sold,

foreign currency fluctuations, amounts payable for securities purchased and interest payable.

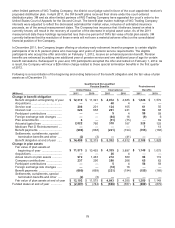

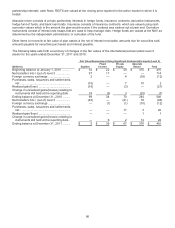

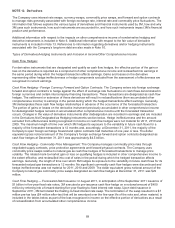

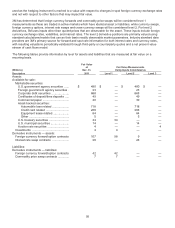

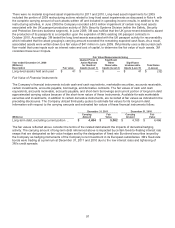

The following table sets forth a summary of changes in the fair values of the postretirement plans’ level 3 assets for

the years ended December 31, 2011 and 2010:

Fair Value Measurement Using Significant Unobservable Inputs (Level 3)

(Millions) Equities

Fixed

Income

Private

Equity

Absolute

Return Commodities Total

Beginning balance at Jan. 1, 2010 .. $ — $ 6 $ 245 $ 22 $ 7 $ 280

Net transfers into / (out of) level 3 .. 2 (2 ) — (1 ) (4) (5 )

Purchases, sales, issuances and

settlements, net .......................... 13 (1 ) (11 ) (6 )

—

(5 )

Realized gain/(loss) ........................

—

— 16 —

—

16

Change in unrealized gains/(losses)

relating to instruments still held at

the reporting date ........................ 1 1 (24 ) 5

—

(17 )

Ending balance at Dec. 31, 2010 ... 16 4 226 20 3 269

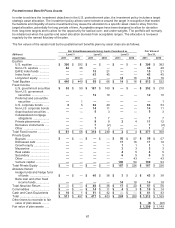

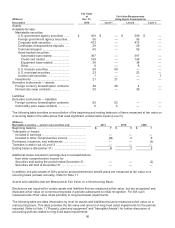

Net transfers into / (out of) level 3 ..

—

— — (2 )

—

(2 )

Purchases, sales, issuances and

settlements, net .......................... (1) (3 ) (43 ) 1

—

(46 )

Realized gain/(loss) ........................

—

1 (31 ) —

—

(30 )

Change in unrealized gains/(losses)

relating to instruments sold during

the period .................................... (1) (1 ) 20 (1 )

—

17

Change in unrealized gains/(losses)

relating to instruments still held at

the reporting date ........................

—

1 15 (1 ) 1 16

Ending balance at Dec. 31, 2011 ... $ 14 $ 2 $ 187 $ 17 $ 4 $ 224